Over the years, I’ve received many compliments for the Profit Radar Report. Some from the financial media (such as Barron’s and Investor's Business Daily), most from subscribers.

Not for Everyone

But, the Profit Radar Report is not for everyone. Over the years I’ve read hundreds of refund requests (all honored with no questions asked). I’d like to share one such request from March 2013.

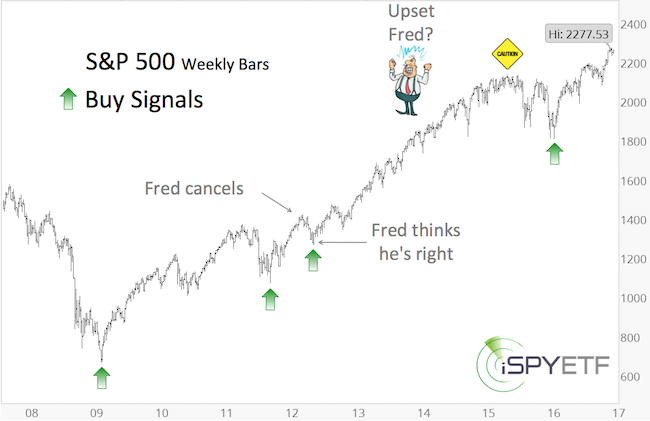

To maintain the person’s privacy, we’ll just call him Fred. Fred sent his cancellation request two weeks after signing up and stated that he doesn't want any part in the Profit Radar Report’s bullish outlook and that he’ll watch from the sidelines while stocks and Profit Radar Report subscribers crash and burn (subscriber Ralf even called me a criminal. His and other testimonials are published here).

Fred (and Ralf) got his money back and we parted ways. About a month late (May 2013) – when the S&P 500 dropped 130 points - it looked like Fred was right. However, this 130-point dropped set up one of the best buying opportunities in recent history. The 130-point drop is dwarfed by the 720-point gain since.

I’m the first one to admit that the Profit Radar Report is not perfect. Although I continuously expected new all-time highs after calling the March 2009 bear market bottom, I rarely found compelling entry points aside from October 2011, June 2012 and February 2016. Why?

Few experiences are more nerve wrecking than (albeit indirectly) losing other people’s money. That’s why limiting risk is my and the Profit Radar Report’s number 1 priority (our 2016 trade record shows 3x more winning trades than losing trades, while the average gain was 3x larger than the average loss).

Was Fred Wrong?

Does that mean Fred was wrong to cancel? Only Fred knows what Fred needs, and no doubt Fred did what he thought was best.

... And he wasn't alone. Check out how many investment pros predicted a bear market in 2014. This list reads like a who's who in investing.

Here is the moral of the story:

It is never a good idea to to follow the crowd (regardless of how credible) and ignore time-tested indicators (such as those monitored by the Profit Radar Report), especially when they point towards continued gains. Knowledge is king. Knowledge neutralizes potentially dangerous biases (and ‘head stuck in the sand’ syndrome).

Become the best-informed investor you know and learn how to spot low-risk and high probability trades here. And yes, if you decide to cancel within 30-days, you will get a full refund ... like upset Fred.

|