For the past couple of months we’ve stuck to our short-term bearish and mid-term bullish outlook (the mid-term bullishness may morph into long-term bullishness).

This means, we’ve been buying dips, but refusing to chase trade to the up side.

We got the first buyable dip on September 9. Between September 9 -13 we bought the SPDR S&P 500 ETF (SPY), iShares Russell 2000 ETF (IWM), and VelocityShares Short-term VIX ETN (XIV).

1st Tell Tale Sign

However, the September 20 Profit Radar Report warned that: “In February and June stocks produced a breadth thrust from their low. Thus far however, the S&P 500 hasn't shown any convincing follow through to the up side. The odds of soaring without a prior test or break of the lows have diminished. We are taking some chips off the table.”

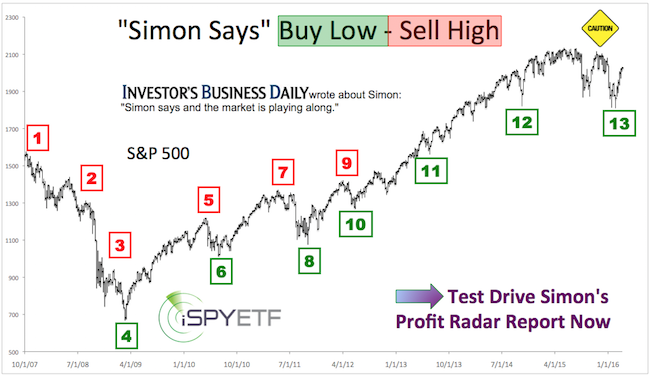

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Over the next few days, we sold IWM and XIV for gains of 2.33% - 14.46%. We continued to hold SPY in case stocks move higher, but closed that position at breakeven on October 4.

The chart below, initially published in the September 11 Profit Radar Report, shows the potential down side targets based on Fibonacci retracement levels.

Ultimately, the scope of this correction depends on whether stocks will retrace the gains since the February low (S&P: 1810) or June low (S&P: 1,992).

We believe the retracement will be more on the shallow side, that’s why we bought the first buyable dip in September.

2nd Tell Tale Sign

The October 2 Profit Radar Report highlighted a concerning Nasdaq constellation: “The Nasdaq-100 and QQQ ETF are near trend channel resistance, and perhaps more importantly, near Fibonacci resistance and the 2000 all-time high (RSI and Nasdaq stocks above their 50-day SMA did not confirm this high). We expect new all-time highs later this year, but if QQQ is going to take a breather, it could be around 120+/-.”

Yesterday (Monday), QQQ matched the September 22 all-time closing high at 119.48, but RSI deteriorated even further, a bearish omen.

3rd Tell Tale Sign

Although the S&P 500 was stuck in a triangle with lower highs and higher lows, internal strength was wilting (the McClellan Oscillator and Summation Index made lower lows – see bottom graphs). The chart below was published in the October 9 Profit Radar Report with this conclusion: "Internal weakness suggests a move lower. Initial support remains around 2,140, followed by 2,120 and 2,100."

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Summary

It seems like stocks want to correct further before moving higher. This correction could stop in the 2,120 – 2,100 zone, but it could also go quite a bit lower.

We will be looking to buy the dip, because a number of indicators suggest a strong rally following this correction.

When we buy, depends on the structure of the decline, bearish sentiment extremes, and whether we see bullish divergences. The Profit Radar Report already identified a beaten down low-risk value ETF and an aggressive high octane ETN with a built in safety cushion to take advantage of the year-end rally.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|