Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on September 21, 2023. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

Days like today, especially after a poor summer like this year, make investors wonder how bad things can get.

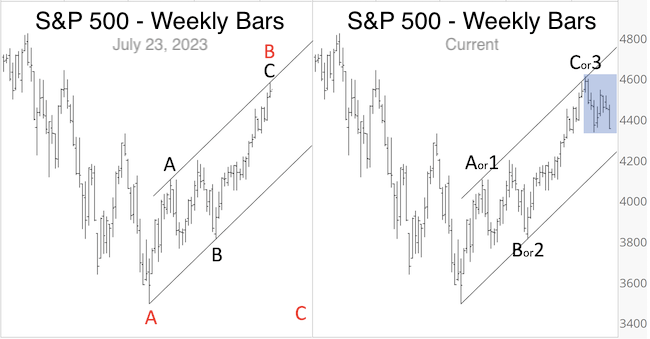

Below is a S&P 500 chart published previously. Before you call me a fear monger though, please keep in mind that:

1) This chart (left portion) was published all the way back in the July 23 Profit Radar Report

2) There is also great news!

While the labels on the July 23 chart reflect the most bearish option, note that the July 23 Profit Radar Report outlines two options:

“The Elliott Wave Theory (EWT) structure is at a point where a pullback is becoming more likely. Shown in the chart below is the most bearish version, but the advance could also be 1, 2, 3 instead of A, B, C. An upcoming decline could be a more shallow wave 4 or severe wave C (red). Based on the Risk/Reward Heat Map, the bearish version is very unlikely, but not impossible."

The correction came 'right on time,' and the blue box (right portion) highlights the price action since July 23 and updates the EWT labels to reflect the bearish (A, B, C) and less bearish option (1, 2, 3 … 4, 5).

As a side note, the wave structure for AAPL is similar and AAPL also put in a textbook top. Detailed analysis was published in the last Market Outlook.

The next chart zooms in on the S&P 500 rally from the October 2022 low and includes some additional short-term support and resistance levels.

Are you ready for some great news?

Here is the first installment of the great news: The August 2, 2023 Profit Radar Report stated that: “The setup for a S&P 500 correction was there. I am hoping stocks will drop further. A move into the 4,300s is easily possible for the S&P without causing any major technical damage.”

The S&P has now reached my initial target. RSI-2 is nearing oversold and next support is around 4,340 (extending to 4,320). This is the first inflection zone since hitting the July high.

This doesn’t guarantee the correction is over, but it’s a zone worth watching for a bounce or more (since RSI-35 confirmed today’s low, I am actually anticipating overall lower prices as long as the S&P cannot close back above 4,450).

Here is the second installment of the great news: Regardless of how low the S&P may go, it is almost certain to come back and at minimum challenge the July high around 4,600. Why so?

It’s for the same reason that on September 25, 2022 - when the S&P traded at 3,693.23 - I stated the S&P will minimally rally to 4,218.

This tiny, little-known indicator has helped me disarm countless sell offs, and even crashes and assure subscribers that the S&P 500 will come back to challenge the highs. It has been 100% accurate since the 2009 bear market low.

If you read these updates regularly, you already know about this incredibly helpful indicator. If not, sign up for the Profit Radar Report, I’ll revisit this topic again in Sunday’s update.

While the S&P 500 has been stagnant (trading at the same level today as June 13, 2023 and April 22, 2022), we’ve found opportunity elsewhere.

We bought DBA on August 21, when it tested trend channel support with RSI-2 over-sold.

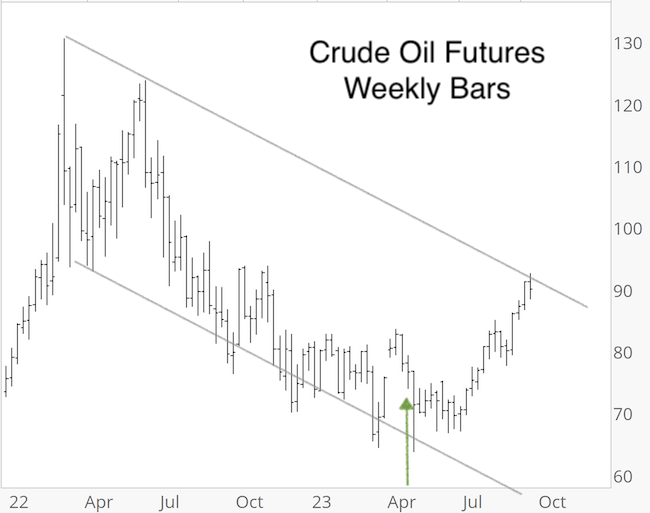

We bought crude oil back in April. Although it was a rough trade initially, we stuck with that position as an eventual rally was expected.

Crude oil has surged lately, and tagged resistance. Although the recent pullback appears temporary, w locked in profits and are observing how price deals with overhead resistance.

For continued updates, purely fact based research, and objective analysis, sign up for the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

|