Is the stock market rigged? Many believe it is … and rightfully so.

However, there are more interesting and pertinent questions, such as:

-

To what extent is the market rigged, and how does it affect me?

-

Why do allegations of a rigged market sprout up right now?

Different Ways to Rig the Market

There are different ways to ‘rig’ the market, and there are different entities to do so.

-

High frequency traders attempt to gain a time advantage.

-

Inside traders try to get information ahead of the crowd.

-

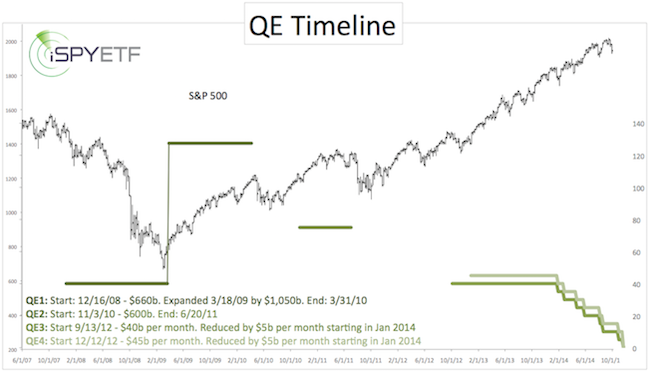

The Federal Reserve and central banks around the globe aim to prop up equity markets via various types of quantitative easing or low interest rates. The chart below plots the S&P 500 against the actual QE liquidity flow to illustrate the correlation (or lack thereof, may the reader judge) between stocks and QE.

Regardless of the exact correlation between QE and stocks, even the Federal Reserve's own research admitted that FOMC meetings drove the S&P 55% above fair value (more details here).

But none of the above is new or shocking.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Why Now?

Perhaps more interesting than who and how is why now?

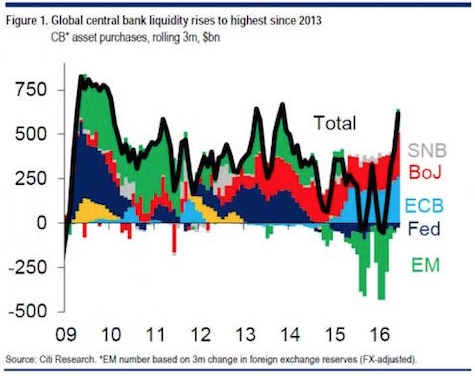

Isn’t it curious that articles and charts (like below) about central bank liquidity driving up stocks are popping up just as the S&P 500 is breaking to new all-time highs?

There were no such claims last August or early this year when the S&P traded below 1,900. Seems like investors (and fund mangers) are fishing for excuses.

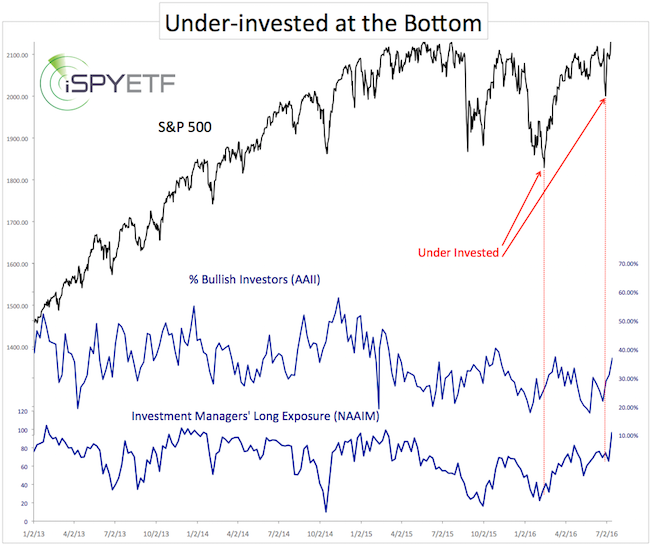

As the chart below shows, investors and fund managers were clearly under-invested at the recent lows. 3 out of 4 large cap fund managers got beaten by the S&P 500 in 2015. How to explain such dismal performance?

Central bank liquidity is a welcome scapegoat. Fund managers could (and do) essential argue: “Our research suggested lower prices, but central banks stepped in and unexpectedly buoyed stocks.”

Boycotting Yourself Out of Profits

This is the most hated stock market rally ever, that’s why it’s gone on for so long.

Today’s market hater is tomorrow's buyer (disgruntled, but 'better late than never'). As long as this cycle perpetuates, there's more up side. We observed this back in 2013: QE Haters are Driving Stocks Higher

Boycotting the market by avoiding stocks may feel like the ethical thing to do, but it hurts the portfolio.

There is no question the market is rigged to some degree, but that’s not necessarily a disadvantage for open-minded investors.

Rigged or not, the stock market has responded reasonably well to time-tested indicators. A number of them pointed to a strong stock market rally.

The key question is not whether the market is rigged, it’s how do you handle a rigged market? Now is the time to be the best informed investor you know.

The latest indicator-based S&P 500 forecast is available here: Stock Market Melt-Up Alert?

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|