Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on November 4, 2021. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

The last free Market Outlook (2 weeks ago) highlighted some of the nonsense coming from the perma and premature bear echo chamber. Here's another look.

8/21/21 - Elliott Wave International: "The top is in."

9/20/21 - Glenn Neely, NEoWave: "The bull market is over!"

9/20/21 - Fox Business: "Stocks could drop 20% or more."

9/28/21 - Kitco: "Bear market is imminent."

9/30/21 - Barron's: "3 Reasons the stock market will keep falling."

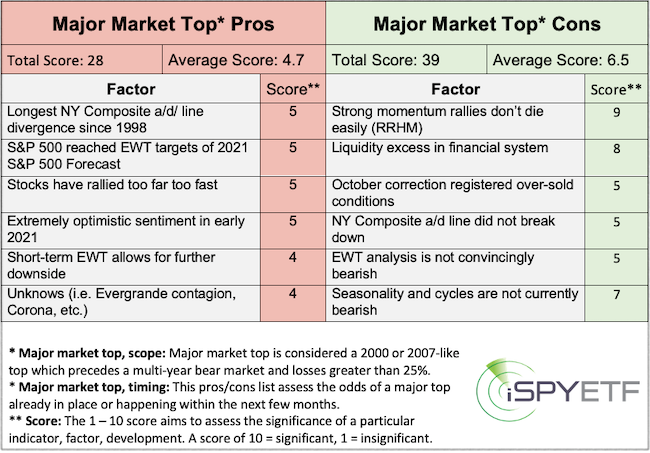

Because of all the bearishness at the time, I had put together a bear market pros and cons list for subscribers of the Profit Radar Report. It's a few weeks old now, but certainly not outdated.

Unlike the strictly data-based Risk/Reward Heat Map (which projected temporary weakness for September/October) the pros/cons list was based on my personal assessment of some of the most important factors and indicators.

The October 24 Profit Radar Report included a detailed look at underlying breadth. In fact, it was so detailed (criteria listed in chart below) that it only returned 4 other similar signal dates. That's obviously a small sample size, but none of the prior signal dates was bearish.

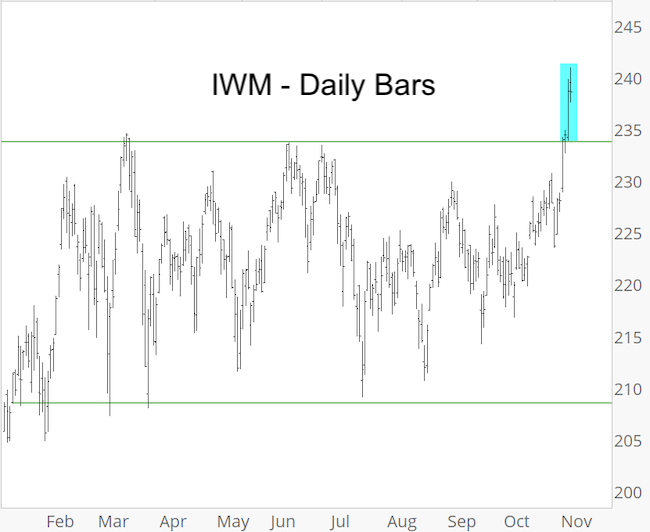

One of this week's biggest stories is the small cap breakout. The Russell 2000 and Russell 2000 ETF (IWM) broke out of a 10-month trading range. My assumption was that this extended range is wave 4 to be followed by wave 5 up. I haven't used Elliott Wave Theory much but the need for wave 5 to new highs seemed obvious, which is why I recommended buying IWM in late August.

Statistically, such breakouts (new high after 6 months without high) have 80% - 90% odds of higher prices 2 and 3 months later.

Continued updates, out-of-the box analysis and forward performance based on historic precedents are available via the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

|