Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on February 5, 2026. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

The January 25 Profit Radar Report warned: “If silver wants to blow off, it can reach 119.50 before this rally leg rolls over into a deeper decline.”

What was significant about 119.50?

The long-term log scale silver chart below shows long-term Fibonacci resistance along with short-term trend channel resistance right around 119.50.

The daily chart shows silver futures peeking at 121.78 and then falling as much as 41.53%.

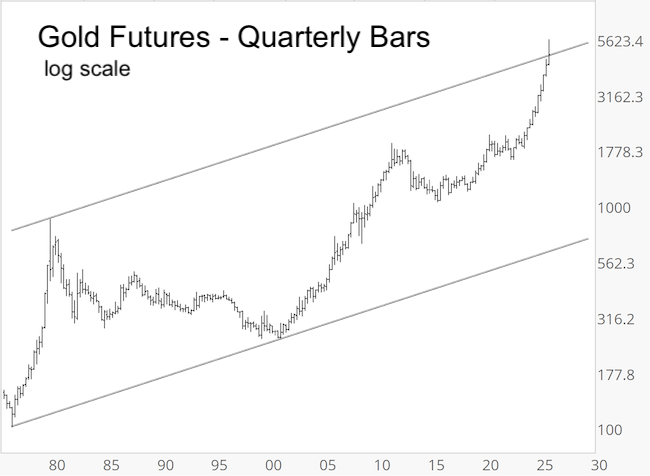

Gold briefly went over its long-term channel and then fell as much as 21.39%.

What’s next?

How do you determine fair value for an asset that triples in less than a year and then loses 41.53% - as the case with silver - within 3 days? You can’t.

Based on my experience with similar frenzies, the parabolic phase for gold and silver is over. After such an emotionally charged pop and drop, price usually enters a period of calibration.

Gold already reached the starting point of the last rally leg of parabolic buying (green line on the daily chart). Immediate down side may therefore be limited.

Silver is actually trading below where it started 'going wild’ (around 82 in January, lower red line on the daily chart). It could now trade in the 70 - 125 range for weeks or months to come. It sounds far fetched, but a drop to ‘where it all started’ - around 54 (green line on the daily chart) - is possible eventually, and would be the lowest risk entry point.

Continued updates and factual out-of-the box analysis are available via the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on January 28. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

Continued updates and factual out-of-the box analysis are available via the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

|