Subscribers to iSPYETF’s free e-mail newsletter receive a market outlook, usually once a week. The market outlook below was sent out on January 28, 2026. If you’d like to sign up for the free e-newsletter, you may do so here (we will never share your e-mail with anyone, just as we don't accept advertising).

The S&P 500 eked out a new all-time high, but is barely trading 1% above its October 30, 2025 high. Ironically, that was also the date of the last update here.

On one hand, I feel bad for the lack of updates. On the other hand, there was no indication that the market would sustainably break in either direction, and I’ve learned not to be an alarmist that gets investors riled up for no reason like others do.

My last update - the one from October 30 - discussed bad breadth and why it did not matter. At the time, 64% of NYSE-traded stocks declined even though the S&P 500 set yet another all-time high. The cumulative NY Composite Advance/Decline line (NYC a/d line) lagged, creating a bearish divergence. Many considered this a bearish omen.

However, historically and statistically, this condition was not a reason to worry and I concluded the article as follows: “Short-term pullbacks continue to be buying opportunities.”

The S&P 500 then pulled back 5%, recovered, and reversed the condition. In mid-January, the NYC a/d line reached new highs repeatedly while the S&P 500 did not. The market went from bearish divergence to bullish divergence.

Does it matter?

I discussed the bullish divergence constellation in the 2026 S&P 500 Forecast as follows:

“The chart below highlights all dates when the NYC a/d line set a new all-time high although the S&P 500 itself did not.

Since 1970, this happened 712 times. 669 of those 712 signals occurred since 2003.

Here is what we observe:

- Bullish divergences do not prevent declines from happening, but

- Declines rarely happen immediately after bullish divergences, and

- Declines following bullish divergences tend to be more shallow”

Of course, as of yesterday’s (Tuesday) close, the S&P eked out another marginal all-time high while the NYC a/d line is a tad behind. Yes, it’s another tiny divergence (once again), and some will make a big deal out of it.

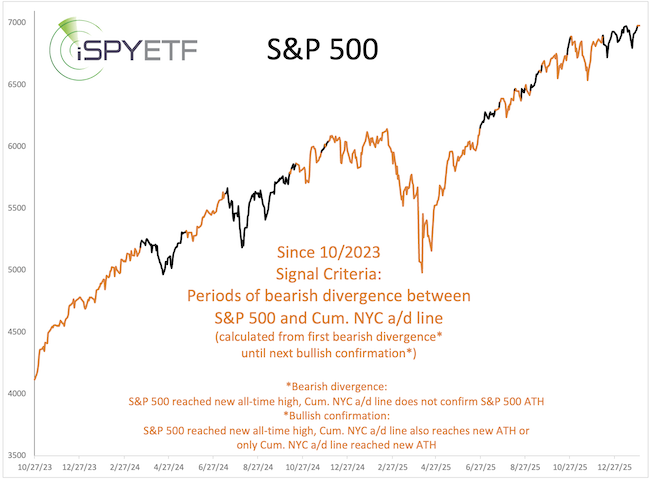

Highlighted below in orange are periods of bearish divergences over the last couple years, and there’ve been many.

In March and July 2024, the divergences were erased just before the S&P pulled back. The November 2024 - February 2025 off/on divergence cluster was eventually followed by the 'tariff tandrum' selloff. The many off/on divergences since June 2025 have not mattered and were erased in December before reappearing yesterday (January 27).

As always, the 2026 S&P 500 Forecast includes a full year projection for the S&P 500, and it is my best guest of what the S&P will do in the months ahead.

While the S&P was churning, subscribers to the Profit Radar Report enjoyed a 18.77% gain in XLV (Healthcare Sector ETF) and bought XLP (Consumer Staples ETF) before it soared from its January low - from 76.62 to 82.23 in 5 days. Keep in mind we're talking about a boring consumer staples with a 2.75% dividend yield.

The complete 2026 S&P 500 Forecast and continued, purely factual updates are available via the Profit Radar Report.

The Profit Radar Report comes with a 30-day money back guarantee, but fair warning: 90% of users stay on beyond 30 days.

Barron's rates iSPYETF a "trader with a good track record," and Investor's Business Daily writes "Simon says and the market is playing along."

|