No other technical indicator has been around as long as the Dow Theory. Dow Theory started out more as an economic theory, which Charles Dow published in the Wall Street Journal around the turn of the 20th century.

Dow’s theory focused on two key economic sectors: manufacturing (industrials) and transportation. If goods were being produced and moving through the economy, it should show up in the price action of the Dow Jones Industrial Average (DJIA) and Dow Jones Transportation Average (DJT). A strong economy would buoy both averages.

The corresponding ETFs for the DJIA and DJT are the SPDR Dow Jones Diamonds (DIA) and SPDR Dow Jones Transportation Average (IYT).

Despite a rather decent century long track record, the Dow Theory sell signal has been dead wrong for well over a year. Why is that, and will the sell signal finally kick in late September/October?

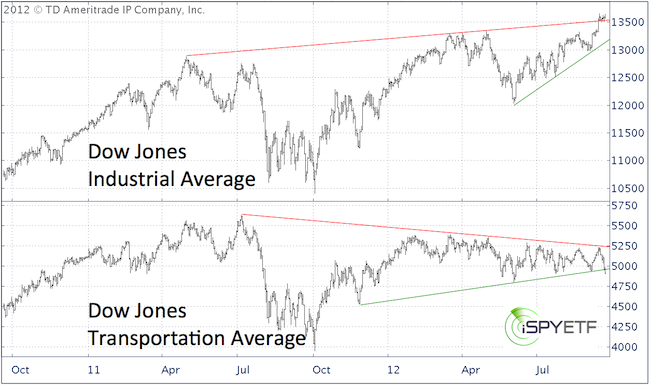

The chart below plots the Dow Jones Industrial Average (DJIA) against the Dow Jones Transportation Average (DJT). There are a number of bearish divergences, but none of them have hindered the DJIA from breaking to new recovery highs.

The Dow’s trend is clearly up while the Transport’s trend is clearly down. The Dow is above resistance while the Transport is below support. Something’s gotta give, will the Dow break down or the DJT catch up?

Historical Performance & Seasonality

An examination of the historical significance of the current divergences doesn’t reveal a bearish bias. In fact, the performance of the Dow has been positive after instances where the Dow traded close to a 52-week high, while the DJT was nearly 10% below its 52-week high.

October is also the beginning of a historically favorable season for the Transports (perhaps due to the upcoming holidays). However, the week after September triple witching and October in general, has a bearish bias for the Dow Industrials.

Technicals

As if the bearish divergence wasn’t enough, the DJIA is now above resistance. The DJT is below support. Technically it will take a move above what’s now resistance to unlock more bullish potential for the Transports, but historical performance and seasonality suggest the risk for Transports is limited. Exactly the opposite is true for the Dow Industrials.

Intangibles

QE3 is here and the massive inflow of liquidity tends to buoy all asset classes including oil. High oil prices in turn cut into the profit margin of transportation companies like FedEx, UPS, Union Pacific, etc.

FedEx has already cut its fiscal 2013 forecast. Chief Financial Officer Alan Graf blamed weak global economic conditions. But that’s old news and already priced into the Transports recent slide.

It is obvious that the Transports refuse to confirm the Dow’s rosy picture, but the bearish omen hasn’t hurt the Dow’s performance either.

I follow and respect Dow Theory, but have learned not to be dogmatic about any one single indicator. The Dow Theory sell signal will be right eventually, but the weight of evidence of technicals, seasonality, and sentiment suggests some weakness for stocks over the near-term followed by year-end strength.

|