2014 hasn’t exactly started off with a bang for stocks.

The S&P 500 (SNP: ^GSPC) and Dow Jones are in the red so far and there’ve been three down right negative and unrelated news items.

1) According to FactSet, 94 out of 107 companies on the S&P 500 that have issued an earnings outlook for the fourth quarter have fallen below Wall Street consensus. This 88% ‘over promise’ rate is the most pessimistic reading since FactSet started tracking the data in 2006.

2) The official U-3 unemployment rate fell from 7% to 6.7% in December. How is that bad news?

Unfortunately, U.S. employers added only 74,000 jobs in December while 347,000 ‘workers’ left the workforce. For every 1 person that found a job, 5 people left the workforce.

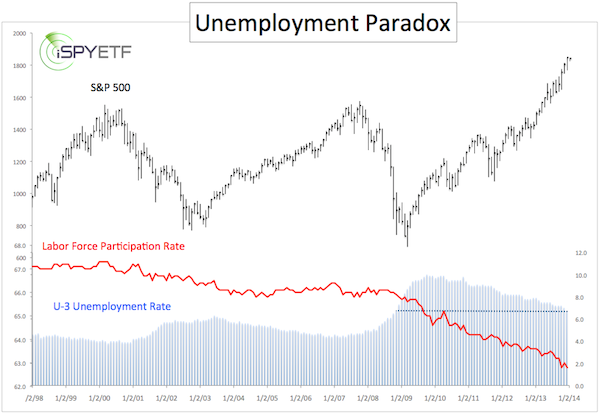

The chart below plots the S&P 500 (NYSEArca: SPY) against the unemployment and labor force participation rates.

In a normal environment the participation rate and unemployment rate do not move in the same direction, just as the cost of living and ones disposable income do not move in the same direction (if one goes up, the other goes down and vice versa).

3) The ‘dumb money’ is getting foolishly giddy about stocks. This data point is not a poll, it’s an actual money flow indicator.

Sometimes there’s a discrepancy between what investors say (polls) and what they do (money flow). Investors not "putting their money where their mouth is’ existed for much of 2013.

Not so now. This indicator shows a clear commitment to stocks with very little fear. This indicator is close to a reading that preceded the 2010 Flash Crash, which shaved 1,000 points off the Dow Jones (DJI: ^DJI) in one day.

The chart that shows exactly how concerning this extreme reading is, along with a fascinating nutshell analysis, can be found here: Flash Crash Indicator Nearing Flash Crash Signal

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|