|

|

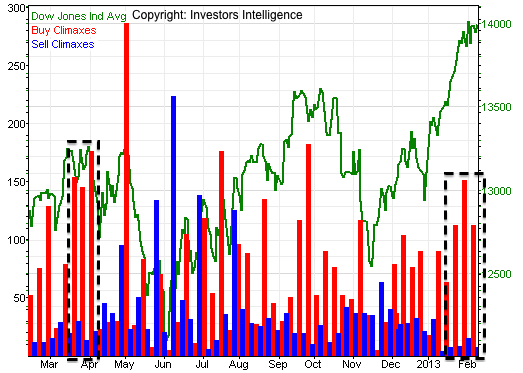

| Stock Buying Climaxes Are On The Rise |

| By, Simon Maierhofer

|

| Wednesday February 13, 2013 |

|

|

|

|

| The S&P 500 is grinding from one marginal new high to the next, while 'strong hand' investors are quietly and persistently unloading stocks. |

|

To understand the merit of buying climaxes we need to know what they are. Buying climaxes occur when a stock climbs to a 12-month high, but closes the week with a loss.

Buying climaxes are a sign of distribution and indicate that stocks are moving from strong hands to weak ones. Strong hands are generally the kind of investors that hold on to stocks through thick and thin.

Weak hands tend to be fickle latecomers that join an established trend that may be running out of steam. Weak hands are trigger happy and quick to sell.

Investors Intelligence publishes buying and selling climaxes every week. We just saw the third consecutive reading above 100. This is not extreme, but reason to be cautious.

The last time we saw three consecutive +100 readings was in March/April 2012. Stocks corrected about 10% thereafter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|