The S&P 500 (SNP: ^GSPC) just had its first 5%+ correction in well over a year.

Some say that’s bullish, because it brought prices down to levels that spark new buying. Others point to a potentially bearish technical breakdown at a time when stocks are over-loved, over-valued, and over-hyped.

Which one is true?

As the old saying goes, there are always three sides to an argument: His, hers and the truth.

The stock/bond ratio provides another dimension to this ‘argument.’

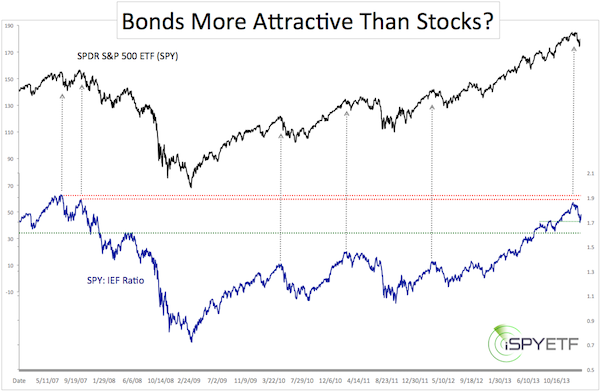

We use the SPDR S&P 500 ETF (NYSEArca: SPY) as proxy for stocks and the iShares 7-10 Year Treasury Bond ETF (NYSEArca: IEF) as proxy for bonds.

The S&P 500 ETF – SPY/IEF ratio chart below shows the SPY/IEF ratio vacillating between support and resistance.

The SPY/IEF ratio rises when the S&P 500 moves higher and bonds move lower.

A spike in the SPY/IEF ratio accompanied every S&P 500 high. This includes the most recent January high.

However, the SPY/IEF ratio did not touch resistance at the most recent high. It also didn’t touch support at the most recent low.

Nothing says that resistance or support need to be met, but often such support/resistance levels act as magnets.

If the SPY/IEF ratio is still in need of touching both support and resistance levels, as a result, we conclude that the January high didn’t mark a major top and last week’s low didn’t mark the end of this correction.

Obviously, this would translate into exciting times ahead.

A detailed forecast for the S&P 500 is provided here:

S&P 500 Forecast: Short-Term Gains vs Long-Term Pain

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|