When the going gets tough, the tough get going.

This can’t be said for stock market bears right now. When presented with a chance to push stocks lower, bears cave under pressure and fail to ‘grab the bull by its horns’.

Earlier this week bears had such a chance to knock the bulls off their throne (at least temporarily) and unlock significantly lower price targets, but they didn’t.

Like in a competitive sports game (imagine football, soccer, tennis, etc.) there’s often one pivotal moment - one missed chance - that turns the game.

The bears had such a chance at S&P 1,814 on April 14.

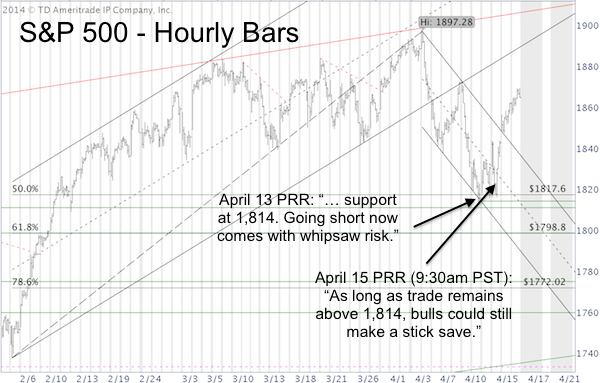

The April 13 Profit Radar Report published this chart (see above) and commented:

“The hourly chart reveals a new short-term parallel channel with support at 1,814 and resistance around 1,850. Going short right now comes with a fair shot of whipsaw risk. A lower risk set up will be to go short if the S&P 500 bounces to 1,850.”

Why was 1,814 so pivotal?

1) It was a confluence of technical support levels (trend channel support, Fibonacci support, and supply/demand support created by November/December highs and lows).

2) Based on Elliott Wave Theory (EWT), the S&P declined in only 3 waves (from April 4 high to April 11 low).

Admittedly, EWT is one of the more exotic tools in our technical analysis toolbox, but it can be helpful. A 3-wave move suggests that the larger trend (which is up) is still in tact.

That’s why the April 15 Profit Radar Report (when this special intraday report was published, at 9:30 am PST, the S&P traded at 1,820) wrote that: “As long as trade remains above 1,814.36, bulls could still make a stick save.”

Quite frankly, I thought that bears would take care of business this time. But what the charts say is so much more important than what I think.

What about the April 13 suggestion to go short at 1,850? A special April 15 evening Profit Radar Report warned of a gap up open and stated:

“If the S&P 500 (NYSEArca: SPY) gaps higher in the morning, we will wait for trade to drop below 1,840 to go short.”

As the updated S&P 500 (SNP: ^GSPC) chart shows, the S&P gapped above the channel and never triggered a short signal.

As the headline brings out, bears need to make a stand almost immediately. Resistance is at 1,874. A move above 1,874 may well lead to new all-time highs for the S&P 500.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|