Nevertheless; “If Santa should fail to call, the bears may come to Broad and Wall,” is one of the most popular Wall Street adages around … and it is dead wrong.

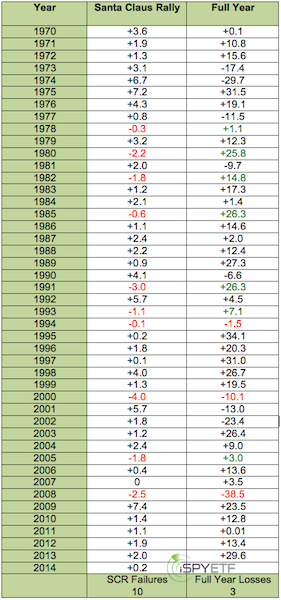

Using the S&P 500 (SNP: ^GSC), there have been ten years without a Santa Claus Rally (SCR) since 1970. Only three of those instances were followed by full-year S&P 500 losses (1994, 2000, 2008).

The table below lists all SCRs and full-year S&P 500 performance numbers since 1970.

Admittedly the 2000 and 2008 SCR failure offered a spectacular warning, but still, the above adage is wrong 70% of the time.

But this adage doesn’t apply to 2014, because the S&P 500 (NYSEArca: SPY) gained a whopping 0.2% in the last five trading days of 2013 and first two trading days of 2014.

SCR Truth

A small SCR gain does not have to translate into a small full year gain.

0.2%, 0.1% and 0.4% gains in 1995, 1997 and 2006 were followed by stellar full-year performances of 34.1%, 31% and 13.6%.

Interestingly, the Nasdaq didn’t participate in this year’s SCR, as the Nasdaq QQQ ETF (Nasdaq: QQQ) lost 0.88%.

Putting the Nasdaq hiccup aside, statistically, the 0.2% S&P 500 SCR gain suggests a strong year ahead … but what serious investor puts their faith into anything Santa related, when there are much better options.

One stock market patterns has been so valuable to market forecasting that I call it legal insider trading (it’s perfectly legal and gives investors an edge). Here’s the big skinny on this legal form of insider trading.

Insider Trading Just Became Legal

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|