Nouriel Roubini is famous. The first few lines on his Widipedia resume tell why: Roubini anticipated the collapse of the US housing market and the worldwide recession in 2008.

In fact, Roubini is one of few economists, analysts, advisors, etc. that got full credit for predicting the post-2007 crash. Roubini attained what many in the financial field covet and so few get: Fame and credibility.

Today, everyone wants to be the next Roubini, which comes with the exclusive right to the phrase ‘I told you so.’ Below is a small sampling of individuals on record predicting a crash:

-

"Russ Koesterich, chief investment strategist at BlackRock

-

Wilbur Ross, billionaire investor

-

Carl Icahn, billionaire activist and investor

-

Marc Faber, publisher Gloom & Doom Report

-

Peter Schiff, chief global strategist of Euro Pacific Capital

-

David Tepper (hedgefund manager) and everyone who rode his coattail … until he decided to turn ‘unbearish’

Here’s a message for all the 'wanna-be Roubinis’ and those hoping the 'wanna-be Roubinis' will be right (this message was originally published in the July 13 Profit Radar Report):

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

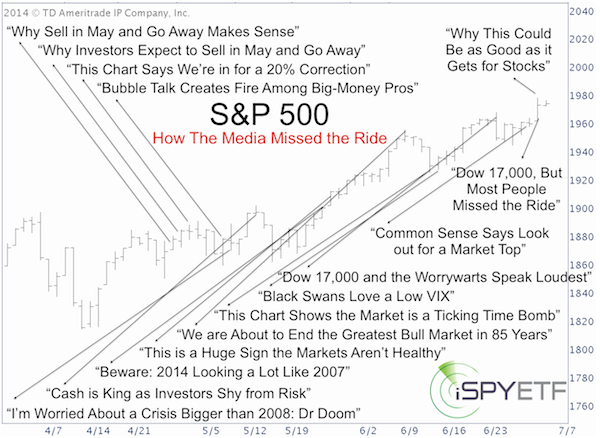

"Like in March/April, the media continues to trash the market and prophesy doomsday scenarios ranging from bursting bubbles to crashes. The S&P 500 (SNP: ^GSPC) rolled over those predictions as the chart below shows.

Here’s a message for everyone vying to be the next Roubini:

A watched pot doesn’t boil and a watched bubble doesn’t burst. The S&P 500 (NYSEArca: SPY) and Dow Jones are not yet displaying the classic warning signs of a major top. There will be a correction, but the bull market won’t be over until most bears turn into bulls or the media stops listening to crash prophets."

That’s a bold statement, but it’s solidly based on facts. The Profit Radar Report examined two powerful market top indicators. One of them is actually a misconception about the VIX.

The second indicator correctly marked the 1987, 2000 and 2007 highs as major tops and revealed that the 2010, 2011 and 2012 S&P 500 highs would only lead to temporary corrections followed by new highs. More details available here: How to Discern a Major Market Top

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|