What do lumber prices have to do with real estate?

A whole lot more than most investors think.

In fact, the correlation between lumber and real estate is one of the least known, but most accurate forward-looking real estate indicators.

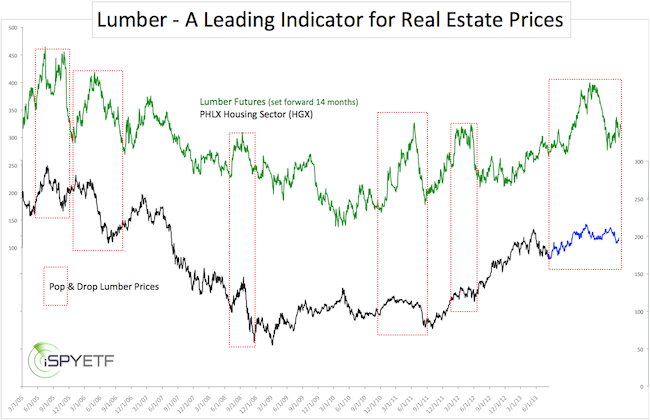

I know this sounds a bit obscure, but you can’t argue with the charts. The long-term correlation chart between lumber and the PHLX Housing Sector Index is available here. Is the Housing and Real Estate Recovery here to Stay?

The key point to keep in mind is that lumber prices lead real estate prices by about 14 months.

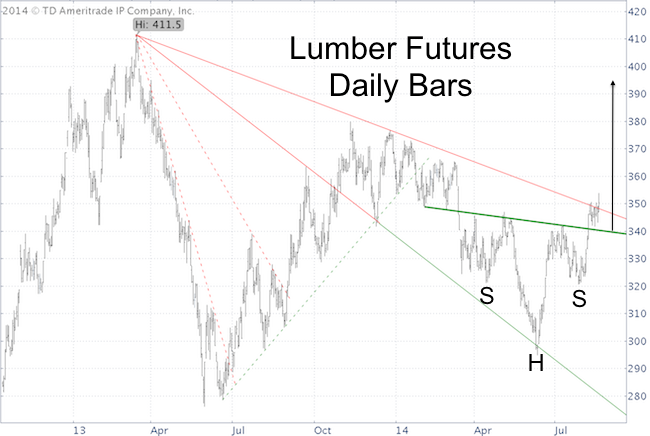

With that in mind, let’s look at the lumber chart.

-

Lumber formed a potential head-and shoulders bottom with the (green) neckline around 340.

-

Lumber pushed above the HS neckline and the red trend line resistance.

-

Measured HS target is around 395

-

As long as trade remains above 340, the HS target remains active

Such a rally (assuming it materializes) should be felt in the housing market about 14 months later.

Of course a relapse below 340 would hint at a failed HS breakout and further weakness, which should translate into softer home prices … 14 months later.

Some of you may still wonder if lumber prices are really a ‘legit’ indicator.

Almost exactly a year ago (August 27), we published a lumber chart with a 14-month outlook via this article: How to Turn the Lagging S&P/Case-Shiller Home Index into a Leading Indicator

With the benefit of hindsight, we can now check if lumbers message a year ago proved correct.

Below is the original August 27 chart. The green graph represents lumber prices set forward by 14 months. The blue graph reflects the actual performance of the PHLX Housing Sector.

Major ‘pops and drops’ in lumber prices (such as in 2013) tend to show up muted in the real estate market - which is what happened again over the past 14 months - but directionally real estate continues to follow the beat of lumber.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|