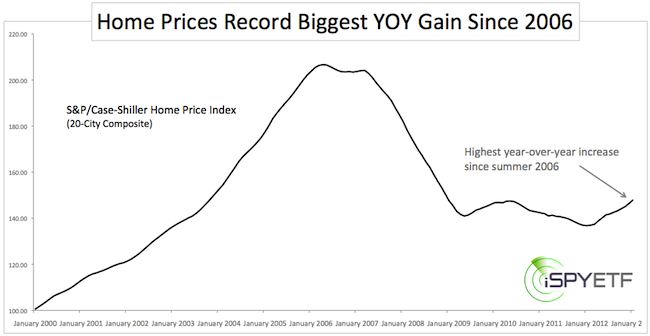

The S&P/Case-Shiller Home Price Index has become an important gauge of the real estate market. Index levels are updated on the last Tuesday of every month (that was yesterday).

The January data (the index uses a 3-month average and is published with a 2-month lag) showed a 0.1% month-over-month and an 8.1% year-over-year increase for the 20-city composite. The YOY figure was the biggest jump since the summer of 2006.

Compared to what we’ve gotten used to, this sounds grandiose. The first chart below puts last year’s gain into perspective. Although it looks less earth shattering, the increase is respectable.

Forward-looking investment decisions aren’t based on rearview mirror-focused analysis, so what’s next for the real estate sector?

Quirky but Credible Leading Indicator

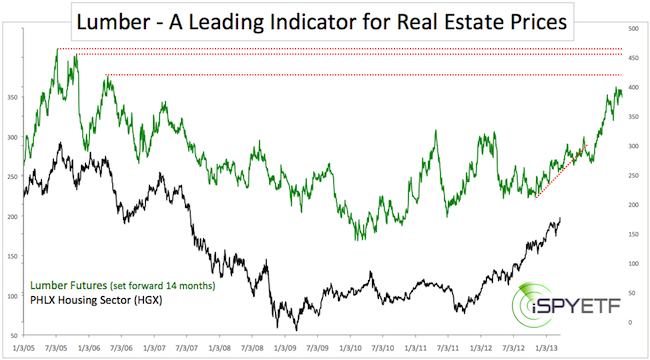

In the October article “Is the Real Estate Recovery Here to Stay?” I introduced a quirky but credible leading indicator for real estate prices – lumber prices.

Lumber is a key component for every house, therefore seeing the connection between the raw material (lumber) and finished product (house) isn’t much of a stretch.

The October article plotted lumber prices set forward by one year against the PHLX Housing Sector Index and highlighted the correlation between major tops and bottoms (something we won’t do today).

Our conclusion, based on the leading lumber prices indicator, was that the housing recovery would last at least into mid-2013.

Why 2013? Because lumber broke through trend line support. At the time we didn’t know if this would end the lumber rally or not.

Today we know that lumber prices recovered and soared on to new recovery highs.

The October article noted that the correlation between lumber and real estate prices might be even better if lumber prices are set forward by more than 12 months. The chart below does just that. It plots the PHLX Housing Sector Index against lumber prices set forward by 14 months.

Obviously, the strong rally in lumber prices bodes well for real estate prices and real estate ETFs like the iShares Dow Jones US Real Estate ETF (IYR) or Vanguard REIT ETF (VNQ).

This indicator allows us to peek ahead a year or so and no further. The lumber rally has slowed as of late and various resistance levels (dashed red lines) are not far away.

It is possible that the real estate rally will run out of steam in mid-2014. If that’s the case, lumber prices will be our canary in the mine.

|