PIMCO’s king of bond funds, Bill Gross, joined the “stocks are dead’ club in late July and CNBC calls the latest rise in stocks the “most hated stock rally in history.”

At the June 4 low (1,267 for the S&P 500) investors and investment advisors hated stocks like fish hate hooks. Despite (actually because of) this negativity stocks keep on keeping on and June 4th turned out to be the second best buying opportunity of the year (see charts below).

But nothing is as persuasive as rising prices, and 12% into the rally investors are starting to embrace the idea of continually rising stocks. The crowd is generally late to the party (thus the term “dumb money”) and this time may be no different.

Investor sentiment is an incredibly potent contrarian indicator. Unfortunately, sentiment-based signals in recent months have been murky, but are starting to make sense again.

Murky Doesn’t Have to be Bad

Murky is not always bad though. The following is what I mean by murky during this summer and how the sentiment picture is starting to clear up.

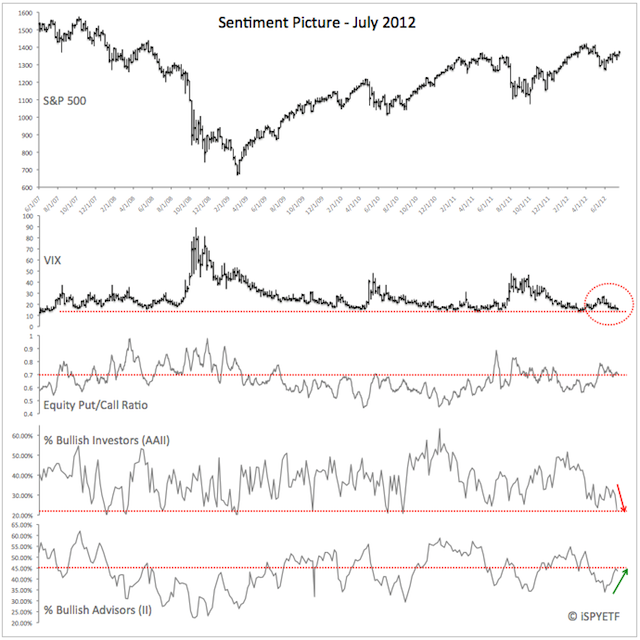

The Profit Radar Report (PRR) continually monitors various investor sentiment measures, which includes the Investors Intelligence (II) and American Association for Individual Investors (AAII) polls as well as the Equity Put/Call Ratio and VIX.

The Sentiment Picture below was published by the PRR on July 20, 2012. Quite frankly it was one of the oddest sentiment constellations I’ve ever seen. The VIX was near a 60-month low parallel to a multi-month pessimistic reading of the AAII poll.

This just didn’t make sense and the simple conclusion was that there is no high probability trading opportunity.

Six weeks and several head fakes later the S&P 500 Index (SPY) is trading a measly 30 points higher than it did on July 20, and even in hindsight we know that there was no high probability trade.

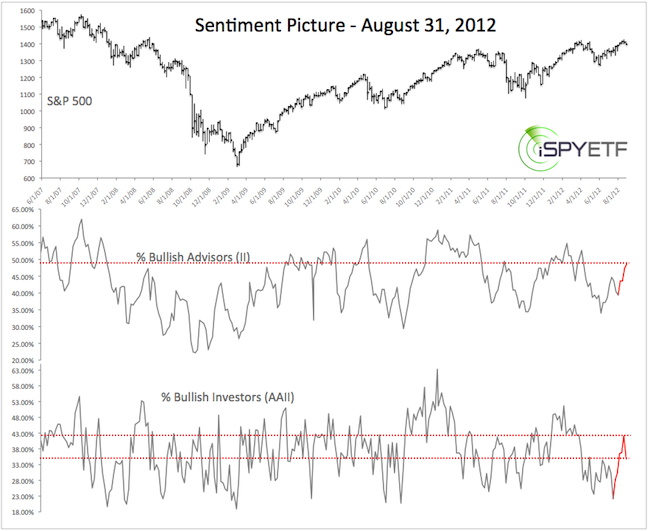

Current Sentiment Picture

The second chart reflects the change of sentiment of investment advisors (II) and retail investors (AAII) since July 20. There’s no excessive bullishness, but rising prices are starting to resonate with investors.

Sentiment alone doesn’t tell us how high stocks may rally or if they are ready to crack right now. When we expand our horizon to include seasonality and technicals we see that September (especially starting after Labor Day) sports a bearish seasonal bias and that there’s strong resistance at S&P 1,425 – 1,440.

There is little reason for investors to own stocks right now. Aggressive investors may choose to pick up some short or even leveraged short ETFs at higher prices.

The Short S&P 500 ProShares (SH) and UltraShort S&P 500 ProShares (SDS) are two inverse ETF options that increase in value when the S&P slumps.

|