Congressmen are legally permitted to trade based on insider information.

There’ve been cases where even the Federal Reserve leaked information to Wall Street before it hit the newswires and average mortal investors.

High Frequency Trading (HFT) is not considered insider trading, but – like insider trading – HFT is based on information not yet received by ‘the herd.’

Legal ‘Insider Information’ for Everyone

Unbeknownst to many, investors also have access to legal ‘insider information,’ but most don’t take advantage of it. All it takes is a computer and watchful eyes.

Allow me to illustrate the power of legal insider info (do not peek ahead to the second chart). Take a look at the S&P 500 (SNP: ^GSPC) chart below. Do you see anything suspicious?

You should, because all the information you need to pocket a 15%+ profit is right there.

Now take a look at the same S&P 500 chart.

One single line changes the complexion of the entire chart. More than that, trading based on the red line break down resulted in a gain of 200+ S&P 500 (NYSEArca: SPY) points to the upside (green ovals) and 200+ S&P 500 points on the down side (red oval).

The red line provided strong support on several instances (green ovals) and a break below support (red oval) was an obvious sell signal. In my actual July 28, 2011 (one day before the red oval break down) note to subscribers, I warned that: “A break below the red trend line may trigger panic selling”.

The legal ‘insider information’ available to everybody is support/resistance (S/R) levels.

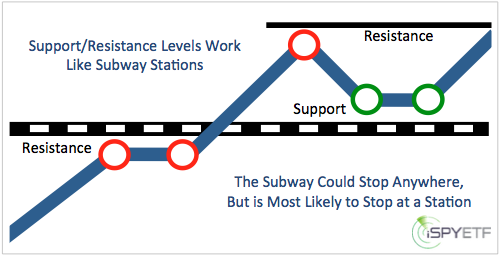

S/R levels work like subway stations. Imagine a New York subway, it can stop anywhere but is most likely to stop at the next station. S/R levels are the most likely place for the market to turn around and reverse trend.

When the market moves beyond one S/R level, it is likely to move on to the next “station.” Once resistance has been broken, it becomes support and once support has been broken it becomes resistance.

The Biggest Benefit of S/R Levels

S/R levels allow us to pinpoint low-risk buy, sell, and stop-loss levels.

The real beauty of S/R levels is that they let us know exactly when we are wrong. There is nearly no guesswork and we can enter any trade with confidence that even the worst-case scenario would be only a small loss. Nearly every trade against S/R levels is a low-risk trade.

Here’s a very recent example.

The Dow Jones (DJI: ^DJI) chart below shows the recent collision of the Dow Jones with long-term trend line resistance.

The initial attempt to move above resistance was met with selling. After re-grouping, the Dow Jones was able to move above resistance and accelerated from there. Prior resistance is now support for the Dow Jones (NYSEArca: DIA).

The Profit Radar report went short at Dow Jones 16,100, covered the short position at 15,745 and noted that a move above the trend line means that the rally is ready to resume and quite possibly accelerate (unfortunately we didn’t get to go long the Dow or S&P 500 as the reversal after the Dec. 18 Fed meeting was just too quick).

This strategy doesn’t just work on paper. The worst trade (in terms of performance) recommended by the Profit Radar Report in 2013 is a 1.02% loss.

But the actual worst trade of 2013 was one not taken. How can that be? Here’s a look at my worst trade for 2013:

My Worst Trade of 2013

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. We are accountable for our work, because we track every recommendation (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|