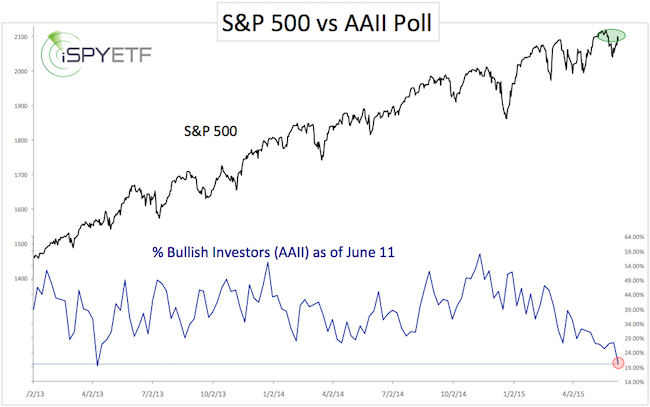

By some measures, investor sentiment turned extremely bearish last week.

Only 20% of retail investors surveyed by the American Association for Individual Investors (AAII) were bullish on stocks, the lowest level since April 2013.

Headlines like the following dominated financial news sites:

-

"Wedbush: Stock market is at major top" – Yahoo!Finance

-

"Stockman: Stocks and bonds will crash soon" – Yahoo!Finance

-

"Low VIX points to tumble ahead for stocks: UBS" – Barron’s

-

"Irrational exuberance is dooming the stock market" – MarketWatch

-

"Beware: Bull market flashing warning signs" – CNBC

-

"S&P 500 rally thins and it's worrying market analysts" – Bloomberg

-

“Why you should care that Robert Prechter is warning of a ‘sharp collapse’ in stocks” – MarketWatch

The June 10 Profit Radar Report commented regarding those developments (and especially the last two headlines):

“Prechter has predicted a sharp collapse literally every single month since late 2009, and it’s unlikely to occur when you see it featured on the Yahoo!Finance homepage.

We’ve been watching the rally thin and become narrower since April, but when the media starts to pick up on such nuances, the information usually isn’t worth too much anymore (an interesting bullish twist of this thinning market was discussed in this June 9 article).

There appear to be too many bears out there right now to send stocks significantly lower. A push to 2,140+ may be needed to flush them out.”

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Perhaps somewhat anecdotally, but nevertheless telling, my article titled “Will the market rally to flush out a horde of premature bears?” (published on July 12 on MarketWatch) got very little attention. It just wasn't bearish enough to attract attention.

Two of my other articles (with neutral or somewhat bullish titles) on the other hand quickly made it into the top 5 most popular article list at MarketWatch.

I’m no genius, but I’m learning that the market is highly unlikely to crash when everyone expects it. A watched pot doesn’t boil.

After all, this is not the first time we’ve been there. I.e. Sep 18, 2013: Who or what can kill this QE bull Market? or July 25, 2014: Bears cry wolf – Everyone wants to be the next Roubini.

The 4-day, 50-point S&P 500 rally has no doubt caused an uncomfortable squeeze for committed bears. I would like to see additional gains, which would likely set up a nice opportunity to short the S&P 500 into July/August.

This opportunity will likely come at a time when fewer people expect it.

A recent article highlighted the similarities between 2011 and 2015 (2011 saw a 20% summer meltdown). Sunday’s Profit Radar Report featured a revealing investor sentiment comparison between June 2011 and June 2015.

You may access this comparison instantly here. It may also be the topic of an article for next week.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|