Remember Hank Paulsen? He was the United States Secretary of the Treasury during the financial crisis.

We don’t hear much about him domestically, but he just shared his concerns about another financial crisis with the German finance/economy newspaper Handelsblatt.

Literally translated, Paulson warns of another financial ‘firestorm’ sparked by one of the following factors:

Too big too fail banks, the ballooning derivatives market, hardly regulated but rapidly growing shadow banks, and the growing influence of Fannie Mae and Freddie Mac could trigger another ‘firestorm’ at any moment.

Below are some staggering stats and numbers (source: Handelsblatt newspaper):

Too Big to Fail

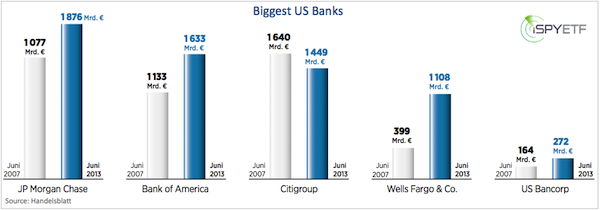

The five biggest US banks have amassed $8.3 trillion in assets. That’s $2.5 trillion more than in 2007. The chart below compares the assets the five biggest banks held in 2007 with today. JPMorgan Chase is 74% bigger today than in 2007, BofA 44%, Wells Fargo 177%, and US Bancorp 66%. Only Citigroup has shrunk.

The problem of too big to fail is that any one big bank (NYSEArca: KBE) can light up the entire financial house of cards.

Handelsplatt reports plans of a corporate ‘last will and testament’, where banks have to outline how they can be wound down most efficiently during times of crisis.

Ballooning Derivatives Market

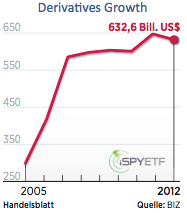

The derivatives market, which sparked the 2007 firestorm, has grown from $586 trillion in 2007 to almost $633 trillion today and is largely unregulated.

Regulators would like to funnel derivatives transactions through clearinghouses in an effort to increase transparency. Clearinghouses are also supposed to take the hit if any of the involved parties bites the dust. This, however only shifts the risk, it doesn’t eliminate it.

Shadow Banks

With assets of $67 trillion (growing rapidly), the shadow banking sector is already half as big as the ‘regulated’ (if you can call it that) banking sector.

Unlike regulated banks, shadow banks (hedge funds, private equity funds, money market fund) are not subject to capital requirements. This is attractive if you’re greedy. That’s why many players leave the regulated market place in favor of more convenient shadow banking.

A positive; G20 members agreed at the recent summit in St. Petersburg to figure out a way to control shadow banking by 2015. Note the wording. Not to control, but find out how to control.

Fannie Mae & Freddie Mac Are Growing

Not only are Fannie Mae and Freddie Mac government controlled, they are more dominant then ever before. 90% of US mortgages are currently guaranteed by the government.

This means that the government, not the free market, determines the price, terms and conditions of mortgages. The lack of free market forces (such as supply and demand) exposes the mortgage/real estate market to renewed excesses.

Hank Paulson observed that every financial crisis is the result of failed political measures, which lead to economic/financial bubbles.

The whole financial leverage subject is a mind over matter issue. Investors don’t mind until it matters.

Investors at large were blindsided by the 2007 financial debacle. Excess leveraged mattered only after the S&P 500 (SNP: ^GSPC), Dow Jones (DJI: ^DJI), and Nasdaq (Nasdaq: ^IXIC) started to tumble and not a moment before.

Bernie Madoff’s investors got bamboozled for years before it mattered. The scam was there all along, but it didn’t blow up until Wall Street got hit.

Bear markets are the best auditors. They reveal things first. The media follows thereafter.

When will the above excesses start to matter again?

The Financial Select Sector SPDR ETF (NYSEArca: XLF) sports a pretty clear pattern and a specific break down point that – once triggered - should get investors (and the media’s) attention and lead to much lower prices and a more critical examination of banking/financial excesses.

A detailed analysis of the financial sector can be found here: The XLF Financial ETF Chart Looks Ominously Bearish

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter or sign up for the FREE Newsletter.

|