Like a knocked out boxer, gold prices just can’t ‘get off the mat,’ and smart money gold traders have been selling into every rally.

Weak gold prices persist despite a weak dollar and a strong S&P 500 (NYSEArca: SPY).

Apparently the smart money doesn’t care that China and almost every other central bank in the world is (allegedly) buying gold (this reasoning is flawed anyway, more below).

The best hope for bullish gold investors might be a return of seasonal strength.

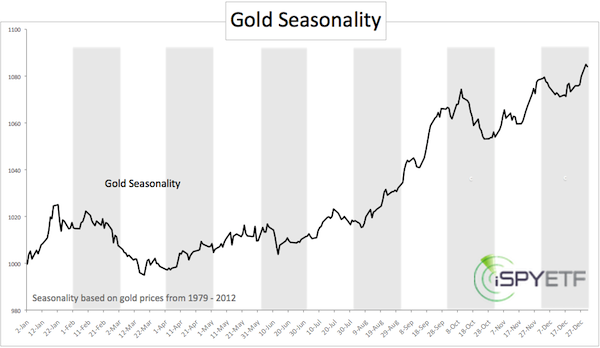

Below is a very unique seasonality chart specially created for subscribers of the Profit Radar Report.

It is based on actual gold prices, but can be applied to gold ETFs like the SPDR Gold Shares (NYSEArca: GLD), iShares Gold Trust (NYSEArca: IAU) and even the Gold Miners ETF (NYSEArca: GDX) and UltraShort Gold ProShares (NYSEArca: GLL).

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

The gold seasonality chart is created from averaging together 33 years of gold behavior. But since gold is at a different price level every year, using just the average gold price would inappropriately skew the result by overweighting the years when it was at a higher level and vice versa.

To equally weigh every year, the price history is adjusted (using a divisor) to begin at the same level on the first trading day of every year. Then each day's values for the rest of the year reflect the percentage change from that first day of the year.

This chart was originally featured in the September 16 Profit Radar Report and projected a seasonal drop starting on October 10.

Seasonality and particular technical analysis are much better forecasting tools than fundamentals. It's now obvious: The fundamental reasoning that gold prices must go up because central banks and China are buying doesn't work.

Here is why this reasoning is flawed: Why The Notion of a Demand Driven Gold Rush is Flawed

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|