The DAX – Germany’s blue chip index – is trading at an all-time high. Like the Dow Jones (DJI: ^DJI), the DAX is made up of 30 blue chip stocks, and many of them are firing on all cylinders.

Unlike most U.S. equity indexes, the DAX is a total return index. The final index number therefore includes dividends ‘reinvested’ into the index. The S&P 500 (NYSEArca: SPY) and Russell 1000 (NYSEArca: IWM) are market-weighted indexes.

There is no U.S. traded DAX ETF, but the iShares MSCI Germany ETF (NYSEArca: EWG) represents a basket of 54 stocks.

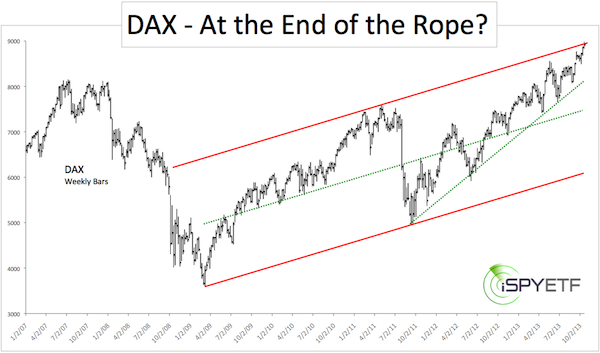

Regardless of the index methodology, the DAX is at a major long-term inflection point.

This is illustrated well by the chart below.

Since 2009 the DAX has been traveling higher in a broad trend channel. This week it reached the upper end of the trend channel, which serves as natural resistance.

As long as prices stay below resistance, there is an increased chance for a correction. A move above resistance would be bullish (as long as prices stay above).

Obviously, the DAX is important for German and European markets. German stocks also have a prominent weighting in the international MSCI EAFE ETF (NYSEArca: EFA).

Perhaps more importantly, foreign investors own 55% of the DAX, with U.S. investors making up a big chunk (related article: U.S. Investors Own XX% of Germany).

Also of interest, the German Central Bank just warned of a severe market correction.

We know that Germans are reserved people and central bankers choose their words wisely, so how serious is such a warning?

A quick but insightful take on the German Central Bank Warning can be found here:

German Central Bank Warns of Severe Correction

Simon Maierhofer is the publisher of the Profit Radar Report.

|