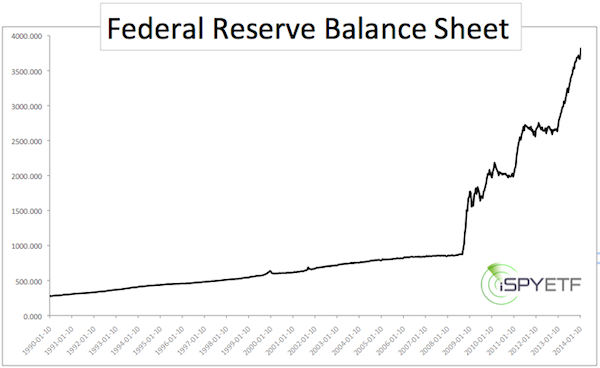

1,273%. That’s how much the Federal Reserve’s balance sheet has mushroomed since 1990.

As of January 22, the Federal Reserve owns $2.228 trillion worth of U.S. Treasuries and $1.532 trillion worth of mortgage-backed securities.

Various other holdings bring the Fed’s balance sheet to $3.815 trillion.

The chart below provides a visual of the sharp balance sheet increase since 2008.

Buying those assets is the easy part, but how will the Fed unload them?

The Fed’s Enemy – Who?

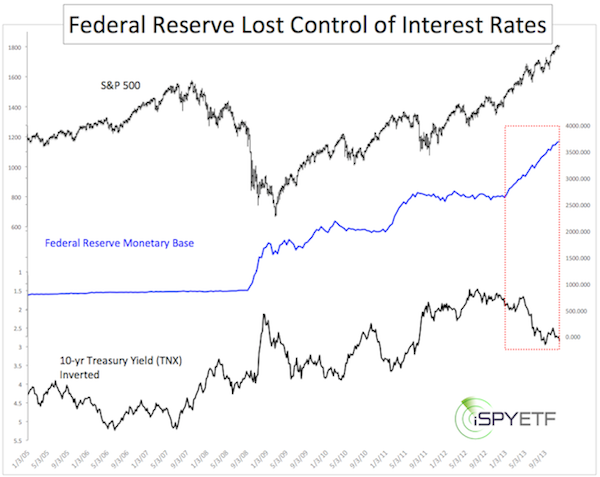

The Federal Reserve engaged in massive quantitative easing (QE) to depress interest rates. Low interest rates forced investors into stocks and defrosted the frozen credit markets.

By extension, QE drove up stock indexes like the S&P 500 and Dow Jones (NYSEArca: DIA). Bernanke termed this the ‘wealth effect,’ which the Fed hoped would spill over into the economy.

The Fed’s biggest enemy is interest rates, rising interest rates to be exact. Particularly important is the 10-year T-note yield (Chicago Options: ^TNX)

Rising interest rates make Treasuries and Treasury Bond ETFs like the iShares 20+ Year Treasury ETF (NYSEArca: TLT) more attractive than stocks.

Rising interest rates also result in higher loan and mortgage rates, which are speed bumps for the economy and real estate.

The chart below, published on December 12, plots the S&P 500 (SNP: ^GSPC) against the Fed’s balance sheet and 10-year Treasury Yields. Yields are inverted and the chart shows that the Fed has lost control over yields.

How The Fed’s Arch Enemy Can Help

The Federal Reserve is the biggest buyer and owner of Treasuries. The Fed can print money and buy securities all day long.

But, who will end up buying all the Treasuries the Federal Reserve has amassed? What happens when the Fed becomes the seller? The Fed can’t print buyers. There has to be a demand or the Fed (if possible) has to create a demand.

Irony at its Best

What makes Treasuries attractive? High yields, which ironically is exactly what the Fed is trying to avoid. High yields are bad for stocks and bad for the economy, but may be the Fed’s only hope to eventually unload assets.

There’s another caveat. High yields translate into lower prices. As yields rise, the Fed’s Treasury holdings – and Treasury ETFs like the iShares 7-10 Year Treasury ETF (NYSEArca: IEF) – will shrink.

Are there other alternatives? How about doing nothing and let the free market do its thing. Perhaps that's what Bernanke and his inkjets should have done all along.

There is another problem largely unrelated to QE and the Federal Reserve. It's ownership of U.S. assets (not just Treasuries).

We know that the Federal Reserve owns much of the Treasury float, but more and more U.S. assets are falling into the hands of foreigners. More and more U.S. citizens have to 'pay rent' to overseas landlords.

Here's a detailed look at this economically dangerous development:

US Assets are Falling into the Hands of Foreign Owners at a Record Pace

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|