|

|

| Dow Jones Averages Did Not (Yet?) Confirm S&P 500 Highs |

| By, Simon Maierhofer

|

| Tuesday February 17, 2015 |

|

|

|

|

| The S&P 500 scored new all-time highs, but none of the major Dow Jones Averages (DJI, DJT and DJU) confirmed this move. There’s also another reason why it may not be a smart move to chase the S&P 500 break out. |

|

The S&P 500 is at new all time highs, and, as the weekly bar chart shows, there’s some room until it hits next resistance.

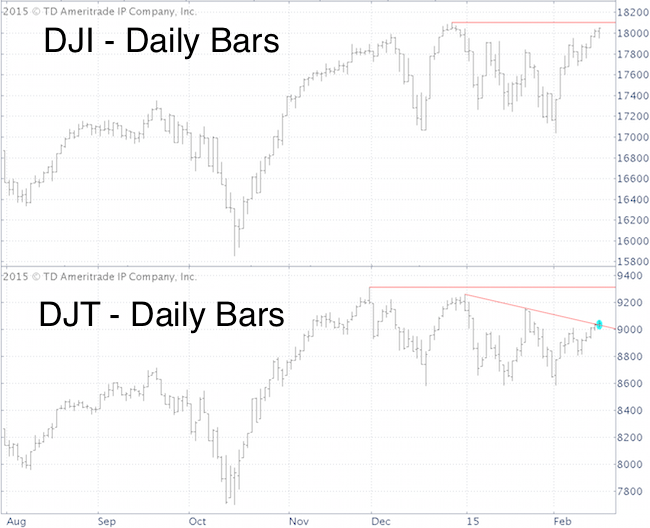

However, the Dow Jones Industrial Average (NYSEArca: DIA) and Dow Jones Transportation Average (NYSEArca: IYT) failed to surpass their prior highs.

But, the Dow Jones Transportation Average (DJT) managed to close above red trend line resistance (blue circle), which is short-term bullish.

Looking for more stock market analysis? >> Sign up for the FREE iSPYETF e-Newsletter

Viewed in isolation, the S&P 500 (NYSEArca: SPY) breakout is bullish, but it has not yet been confirmed by other major market participants.

The trend is your friend ... until it ends. Seasonality suggests a rally pause. Here’s a brand new and detailed S&P 500 seasonality chart.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|

|

|

|

|

|

|

|

|

|

|

|

|

|