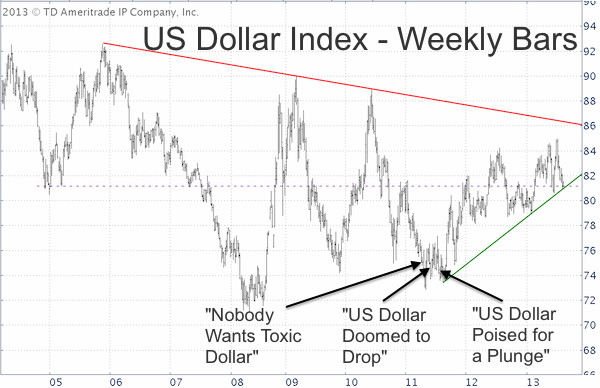

According to analysts, the US dollar has been doomed ever since the Federal Reserve started QE back in 2008. Every new round of QE draws the dollar doomsday crowd out of their den. To wit, I’ve included a few headlines below:

April 8, 2011: Toxic Dollar: Why Nobody Wants US Currency – CNBC

June 15, 2011: Dollar Doomed to Drop – UBS Technical Analyst

July 28, 2011: U.S. Dollar Poised for a Plunge – Peter Schiff

But nearly five years later, the greenback is holding its ground.

It may not be the strongest currency of the global currency basket, but the US dollar today – and that may be hard to believe - is trading exactly where it was back in 2004 (dashed purple line).

Albeit choppy, since August 2011 the dollar has consistently climbed from higher lows to higher highs.

Connecting the recent lows creates obvious support (green trend line).

The US Dollar Index came within striking distance of this trend line last week.

Will Support Hold?

A trend line is called a trend line because it delineates a trend. In this case an up trend. The trend remains up as long as price stays above the trend line.

Being aware of such trend line support is important for at least two reasons:

1) The trend line makes it clear that the dollar is at a key inflection point. Key support is like a rung on a ladder. If the rung breaks, you fall. If support fails, the dollar falls. If support holds, the dollar should ‘climb up.’

2) Dollar strength or weakness is not just a currency story; it’s also an equity event. There is a correlation (see below) between movements of the US dollar and stocks. A US dollar rally may lead to falling stocks. Why?

A falling dollar is good for exports and corporate profits and therefore good for broad US indexes like the S&P 500 (SNP: ^GSPC). A rising dollar is generally bad for corporate US profits.

Based on my assessment, the odds of a sustained dollar rally are currently greater than the odds for a decline.

The PowerShares DB US Dollar Bullish ETF (NYSEArca: UUP) provides long US dollar exposure. If support fails, it may be time to look at the PowerShares DB US Dollar Bearish ETF (NYSEArca: UDN) or CurrencyShares Euro Trust (NYSEArca: FXE).

Exactly how strong is the correlation between stocks and the S&P 500 (NYSEArca: SPY)? Could a US dollar rally sink stocks?

This article about the US Dollar/Stock Correlation shows exactly what a strengthening dollar would mean for US stocks.

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|