All good things come to an end.

What goes up must come down.

Both of those clichés will certainly catch up with this bull market.

In fact, retail investors appear ready to bury the bull right now and slap an RIP sign on it.

Based on the latest AAII (American Association of Individual Investors) poll, not even a complimentary 9-foot pole would entice retail investors to ‘touch’ stocks.

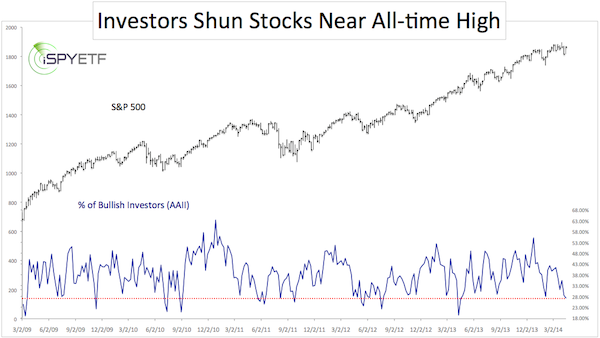

The chart below plots the percentage of bullish investors polled by AAII against the S&P 500 (SNP: ^GSPC).

Last week only 27.22% of polled retailed investors were bullish on stocks (red line).

That’s unusual considering that the S&P 500 (NYSEArca: SPY) is still within a few percent of its all-time high.

The AAII poll is not the only sentiment gauge around. In my humble opinion it is actually one of the most volatile and least accurate gauges. Nevertheless, ignoring it would be as shortsighted as elevating it to a fail proof indicator (the Profit Radar Report publishes a full panel of sentiment gauges once a month).

The simple truth is this: Nobody rings a bell on the top. Major peaks come as a surprise and a top right now would be the first one in history to be foreseen by retail investors.

Don’t get me wrong, I believe the S&P 500 and cohorts are due for a correction, but bulls will continue to torture bears.

One of those ‘torture instruments’ may be new all-time highs (followed by a correction?). One exotic technical indicator that suggested a bounce at S&P 1,814 points towards new all-time highs.

You can read about it here, along with a short-term forecast for the S&P 500:

S&P 500 Short-Term Analysis - This is the Bear's Last Chance

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|