The S&P 500 is at new all-time highs, so it may be appropriate to call to mind - and then discgard - all the bear market chatter of recent months.

Here is just a small selection of bear market headlines:

-

Barron’s: “Bracing for a Bear Market” – February 19, 2016

-

CNBC: "Gartman: It's Definitely a Bear Market this time" - February 7, 2016

-

Forbes: “Investor Alert: We’re Firmly in a Bear Market” – January 25, 2016

-

MarketWatch: “If it Looks Like a Bear and Feels Like a Bear, it Probably is a Bear” – January 14, 2016

-

Benzinga: “The Bear Market is not Over Yet” – September 30, 2015

-

Forbes: “Here Comes the Recession and Bear Market” – January 6, 2016

-

Kiplinger: “Best Funds for Riding out a Bear Market” – September 15, 2016

-

Time: “The Next Bear Market Won’t Roar a Warning Just for You” – September 12, 2015

-

Motley Fool: “3 Timeless Tips for Surviving a Bear Market” – September 11, 2015

-

Investorplace: “Why the Bears will Keep Winning” – February 9, 2016

We never bought into the bear market idea.

Reasons for 2016 Bullishness

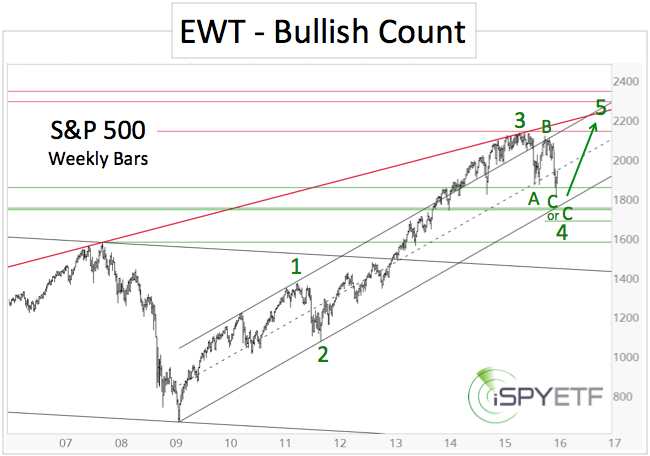

The Profit Radar Report’s 2016 S&P 500 Forecast expected new all-time highs in 2016, as illustrated by this projection published at the beginning of the year.

Barron's rates iSPYETF as a "trader with a good track record." Click here for Barron's assessment of the Profit Radar Report.

Double Kickoff

Our bullish outlook was confirmed by the February ‘Kickoff’ rally, which was discussed in this article: 2016 Bear Market Risk is Zero Based on this Rare but Consistent Pattern

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

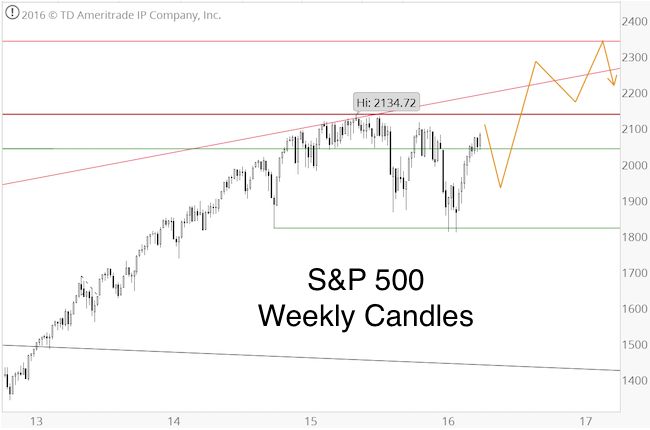

The April 17 Profit Radar Report featured another liquidity study and a more detailed S&P 500 projection (see chart below) along with the following commentary: “The most likely longer-term implications of our liquidity study remain in harmony with our 2016 S&P 500 Forecast: New all-time highs.”

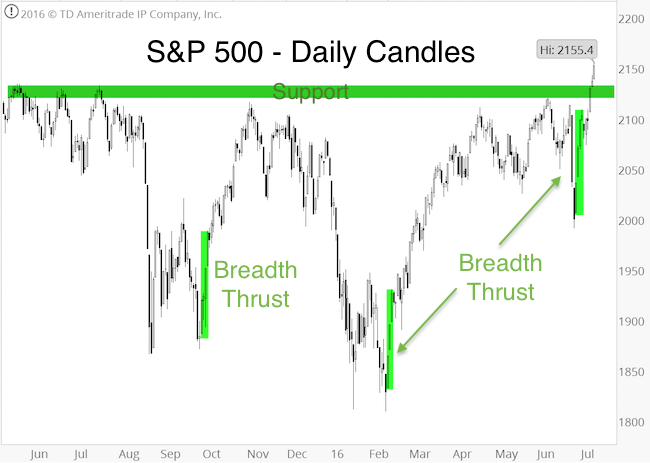

Another breadth thrust, or kickoff rally, launched in late June, two trading days after the Brexit vote (see chart below).

The post-Brexit kickoff rally sported three bullish developments:

-

Up volume surge

-

Advancing stocks surge

-

New NY Composite a/d highs

The July 4 Profit Radar Report included a detailed analysis of this triple breadth thrust and concluded: “The NY Composite a/d lines are already at new highs, although the S&P 500 is not yet. This, along with the breadth thrust, strongly suggests that the S&P will follow in the not so distant future.”

The ‘not so distant future’ became reality five trading days later.

Buoyed by the breadth thrust, the S&P 500 gained the escape velocity needed to break above the glass ceiling near 2,130, which now serves as initial support (horizontal green bar).

Stocks may pull back due to short-term overbought conditions, but with or without pullback, higher highs are likely. It’s a buy the dip market.

Continued updates are available via the Profit Radar Report.

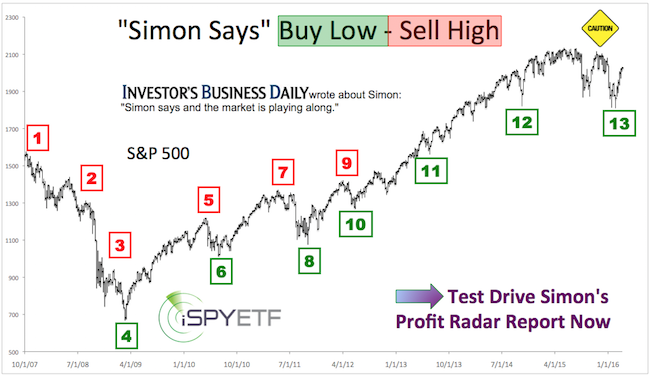

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|