The 30-day Federal Funds Rate (FFR) is the rate that banks charge each other for overnight loans to meet their reserve balance requirements. The FFR, in essence, acts as the base rate for all other U.S. interest rates.

With a couple of tweaks the stale FFR can be turned into a forward-looking indicator. Here are the tweaks:

-

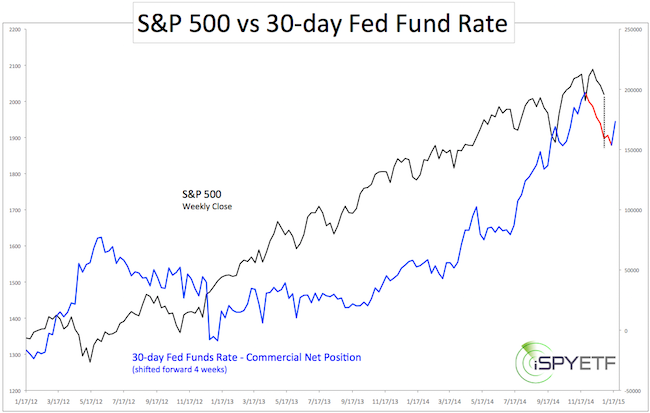

We look at FFR sentiment provided by the commitment of traders (COT) report. We are mainly interested in the net positions of commercial traders (considered the ‘smart money’).

-

We shift the COT sentiment data forward by 4 weeks.

We used the FFR to spot onset of last year’s May rally (when everyone was looking for ‘sell in May and go away’). Fed Fund Rate Suggests S&P 500 Rally

The January 4 Profit Radar Report drew attention to the following:

“Commercial traders slashed their bullish 30-day Federal Funds Rate (FFR) bets by 37,812 contracts, the largest drop since December 2012. The correlation doesn’t always work, but the biggest drop since December 2012 is noteworthy. The FFR warns of a correction.”

The chart below is an updated version of the one featured in the January 4 Profit Radar Report. It plots the S&P 500 (NYSEArca: SPY) against the net FFR position of commercial traders.

Last week’s COT report showed a solid uptick in commercial’s long positions, but 1) it remains to be seen if the trend continues up and 2) there appears to be more down side before any up tick.

The FFR harmonizes with most other indicators I follow. A more detailed S&P 500 forecast is available here: Short-term S&P 500 Forecast.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|