It’s been kind of quiet the last 2 weeks, but lets not forget stocks distinctive performance prior to this relative calm.

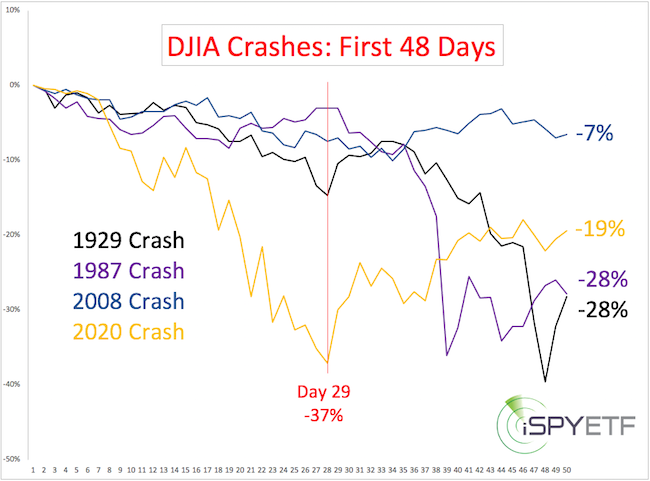

For some perspective, the chart below compares the first 48 days of the 2020 bear market with the first 48 days of the 1929, 1987 and 2007 bear markets. By day 12, the Dow Jones Industrial Average (DJIA) showed it was intent on carving out its own path. By day 29, it was down 37.09% an destroyed any correlation to prior crashes.

It was around the crash low, on March 26, when the Profit Radar Report stated that: “We anticipate a recovery towards 3,000 for the S&P 500 over the next couple months,” which implied a 36% rally from the low.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report

Such a strong rally would be quite unusual. How unusual?

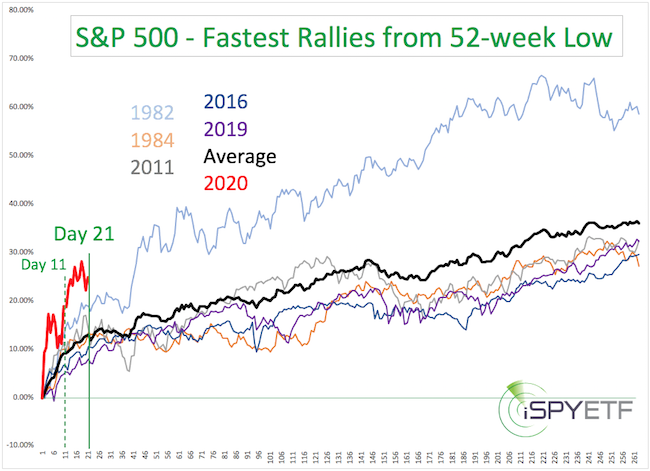

The April 7 Profit Radar Report pointed out that: “It took the S&P 500 just 11 days to retrace more than a Fibonacci 38.2% of the previous losses. This is a very quick retracement. Since 1970, there were only 5 other times where the S&P retraced more than 34% that quickly. The chart below shows the forward performance of those 5 times along with the average. As you can see, returns were rock solid.”

If you enjoy quality, hand-crafted research, sign up for the FREE iSPYETF e-newsletter & market outlook

Below is an updated version of the chart first published on April 7. The red graph represents the 2020 rally, which has been even more 'fast and furious' than the previous set of ‘most furious rallies from a 52-week low.’

In a nutshell, we just witnessed the fastest ever drop and pop in history. What’s next?

The S&P 500 is nearing 3,000, the up side target mentioned in the March 26 Profit Radar Report, and the April 15 Profit Radar Report warned that: “The S&P 500 has almost reached our target and up side potential has become less attractive.”

Here is one reason why: At 2,885, wave C equaled wave A, which is natural resistance. There are many different ways to interpret the structure (according to Elliott Wave Theory), but at this point the rally from the March low appears to be 3 waves.

We’ll have to see if it stays at 3 waves (usually indicative of a counter trend move) or turns into 5 waves (usually indicative of a directional change, in this instance from down to up).

Regardless, a break below support shown at 2,730 - 2,700 is needed to unlock more down side risk.

A break above 2,900 could lead to 3,000+, but such a rally may not stick.

Continued updates, projections, buy/sell recommendations are available via the Profit Radar Report.

UPDATED S&P 500 FUTURES CHART

Wednesday's (4/29/20) recovery high likely turns the rally from the March low into a 5-wave advance. Upon completion of wave 5 (it already reached its minimum target, but could still move higher), there should be a sizeable decline followed by another rally above 3,000.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|