An updated short-term S&P 500 outlook is available here

In recent weeks I published several forward projections for the S&P 500. All of them had two things in common:

-

A bottom somewhere around 2,600

-

A rally towards 2,900

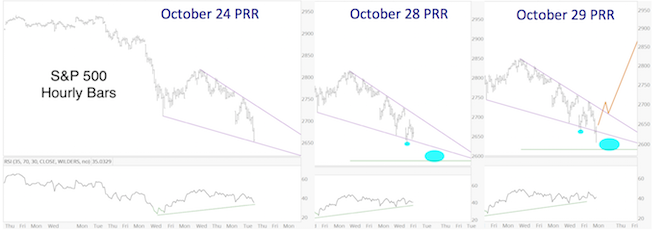

The first chart shows a progression of the ending diagonal (published in the October 24, 28, 29 Profit Radar Reports) we used to identify the bottom and subsequent pop (blue oval was ideal down side target).

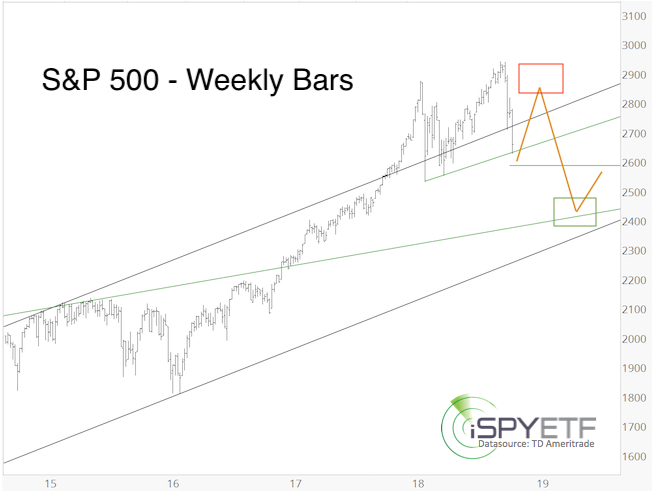

The second chart is the longer-term projection published in the October 28 Profit Radar Report. According to this projection, the S&P 500 was to bottom around 2,600 and rally into the red box up side target.

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Up side Target (almost) Captured

Since the up side target has almost been reached, it’s time to discuss the odds of a potentially scary ‘pop and drop’ scenario.

The October 28 Profit Radar Report stated that: “The projection (see chart above) provides a visual of the ideal path ahead. The upcoming bounce (either wave 2 or B) should reach 2,830 and perhaps higher (wave B could even bring new all-time highs), followed by another leg down.”

At the time, it was not important whether the bounce is wave 2 or B. Why? Both had the same minimum target (around 2,830). Now that the S&P is close to the minimum target, it’s important to know the difference.

Wave 2 vs Wave B

-

Wave 2: If this bounce is wave 2, it is not allowed to exceed the September high (2,940.91), and should ideally stop in the 2,812 - 2,869 range (61.8 - 78.6% Fibonacci retracement). Once complete, the wave 2 rally is followed by a strong wave 3 decline (along with waves 4 and 5).

-

Wave B: If this bounce is wave B, it could, but does not have to, reach new all-time highs.

The chart below includes a number of updated resistance/target levels:

-

2,830: Fibonacci projection level going back to 2002

-

2,853: EWT wave A = C

-

2,869: 78.6% Fibonacci retracement

-

2,880 & 2,921: Open chart gaps, which tend to act like magnets for price

As of Wednesday's close, the S&P ended near over-bought, but without bearish divergences. This suggests short-term weakness should be followed by at least one more high.

Conclusion

It appears that at minimum another down/up sequence is required before a larger drop becomes an option.

Based on seasonality, continued gains and new all-time highs are possible.

I will be monitoring breadth, momentum and sentiment for extremes, internal weakness, or divergences to assess the odds of a serious reversal to the down side.

An updated short-term S&P 500 outlook is available here.

Continued updates will be available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF e-Newsletter to get actionable ETF trade ideas delivered for free.

|