Excessive optimism is generally bad news for stocks. That’s why sentiment analysis can be a helpful tool in spotting (major) market tops.

There’ve been a number of commentaries suggesting an impending bear market (either because today’s market allegedly mimics the 1928 market or simply because this QE bull is getting old).

Does investor sentiment point towards a major top?

The Profit Radar Report always looks at the ‘3 pillars of market forecasting.’ 1) Technical analysis 2) Sentiment analysis 3) Seasonality & cycles.

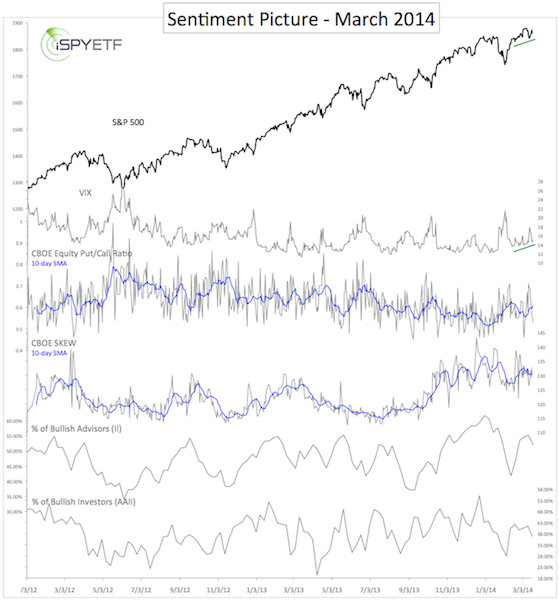

The below chart was featured in the March 20 Profit Radar Report and plots the S&P 500 (SNP: ^GSPC) against five measures of sentiment:

-

VIX

-

CBOE Equity Put/Call Ratio

-

CBOE SKEW

-

% of Bullish Advisors (II)

-

% of Bullish Investors (AAII)

We saw a number of sentiment extremes in December and January.

In fact, the December 20, 2013 Profit Radar Report looked at the same gauges and suspected that: “Bullish sentiment will catch up with stocks in January. This should cause a deeper, but also temporary correction.”

That correction came and left. It also reset sentiment. There are no extremes, at least not the kind that point towards a major S&P 500 top.

Seemingly Minor, But Intriguing

However, the green lines highlight an intriguing divergence between the S&P 500 (NYSEArca: SPY) and VIX.

Normally the S&P and VIX move in opposite directions. But since mid-February they’ve moved in the same direction. This is unusual and unsustainable. Either the VIX or S&P 500 has to break down to restore the historic correlation.

There’ve been two recent cases where the S&P and VIX moved in the same direction. Both had the same outcome.

More details here (this is a free excerpt of the Profit Radar Report):

VIX and S&P 500 Sport Bearish (for S&P) Divergence

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|