Question: As a lay person, it's been my understanding that the price of gold will move up at times of panic. Could you pleas enlighten me as to why you recommended to short gold. Thanks! - Ben - Pasadena, CA

Answer: Many factors influence the price of gold, but panic is not one of them (at least not consistently). For example, in October 2008, the last time stocks crashed, gold lost as much as 27%. It’s ironic that many investors perceive gold to be a hedge against panic, yet gold fell hard during the two biggest panic months of our generation (October 2008 and March 2020).

Why did gold almost drop 15% in the last two weeks.

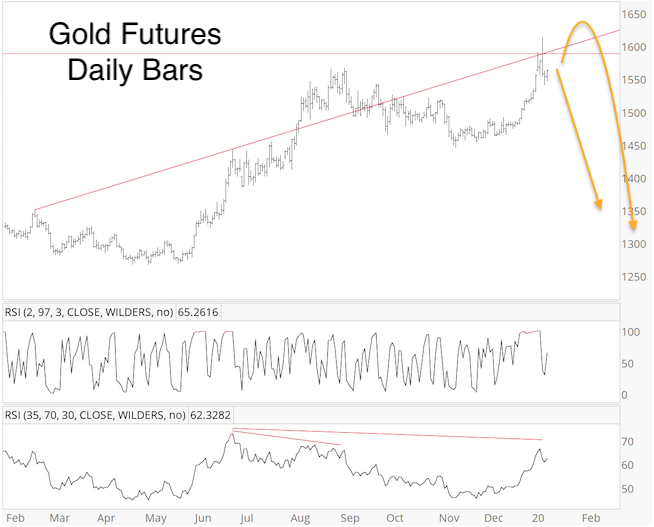

Back in January, the Profit Radar Report stated that gold is currently in limbo, but will drop sooner or later. The question was not if, but when. The January 12, 2020 Profit Radar Report recommended to leg into a short position - short via gold futures, short SPDR Gold ETF (GLD) or ProShares UltraShort Gold (GLL) - and projected the eventuality (now or later - yellow lines) via the yellow lines:

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

The February 23 Profit Radar Report featured this chart and warned:

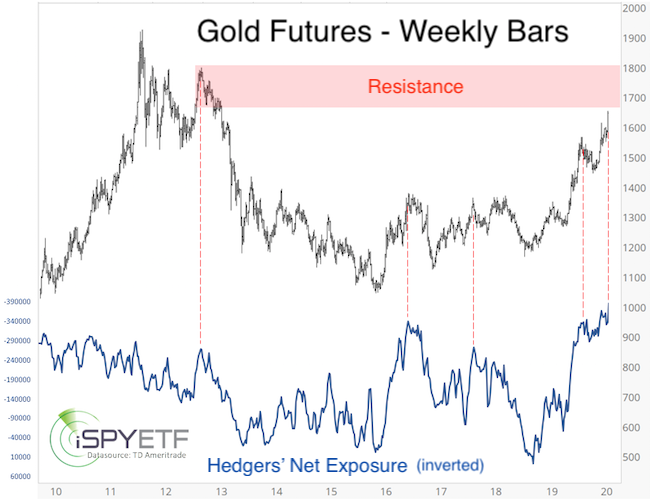

“As the weekly chart shows, commercial hedgers (smart money) increased their short exposure to a new record. We’ll be looking for a low-risk entry to add to our existing short position. In fact, I’m tempted to add (or initiate) to our short exposure right now, but it’s prudent to allow for higher prices or wait for a close below 1,615.

Gold’ is likely in wave 3 of 5 or wave 5 of 5. In commodities, wave 5 is sometimes the ‘blow-off’ wave that extends higher then expected. The upper target for such an extension is in the low 1,700s, but it’s by no means required. RSI-2 is seriously over-bought, and the larger-scale bearish RSI-35 divergence remains in tact.”

If you enjoy quality, hand-crafted research, sign up for the FREE iSPYETF e-newsletter & market outlook

The red box highlighted price resistance for gold. The vertical dashed red lines outline what happened every time commercial hedgers (smart money), revved up their short exposure: Gold prices dropped, and they usually did so swiftly.

Ascertaining that gold prices were about to fall was the easy part. The question now is: How low can gold go?

Gold is likely working on a ‘sling shot’ decline, meaning that prices will jolt higher once they’ve pulled back enough. However, that pullback could be very severe. Short-term, support is around 1,450, and price could bounce from there, but ultimately I’d like to see prices drop even lower.

Continued updates, projections, buy/sell recommendations are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|