The Profit Radar Report monitors dozens of indicators to compile a broad-based and educated forecast. All those indicators fall into one of the following four categories:

-

Supply & Demand (Liquidity)

-

Technical Analysis

-

Investor Sentiment

-

Seasonalities, Cycles & Patterns

The September 2 Profit Radar Report included a detailed analysis of investor sentiment (called the Sentiment Picture). Based on sentiment, the September 4 Profit Radar Report stated that: "A fakeout breakout would burn a lot of premature bears, and may be just what is needed to clear the air for another leg lower."

Barron's rates iSPYETF as "trader with a good track record" and Investor's Business Daily says: "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Below is a reprint of the entire Sentiment Picture:

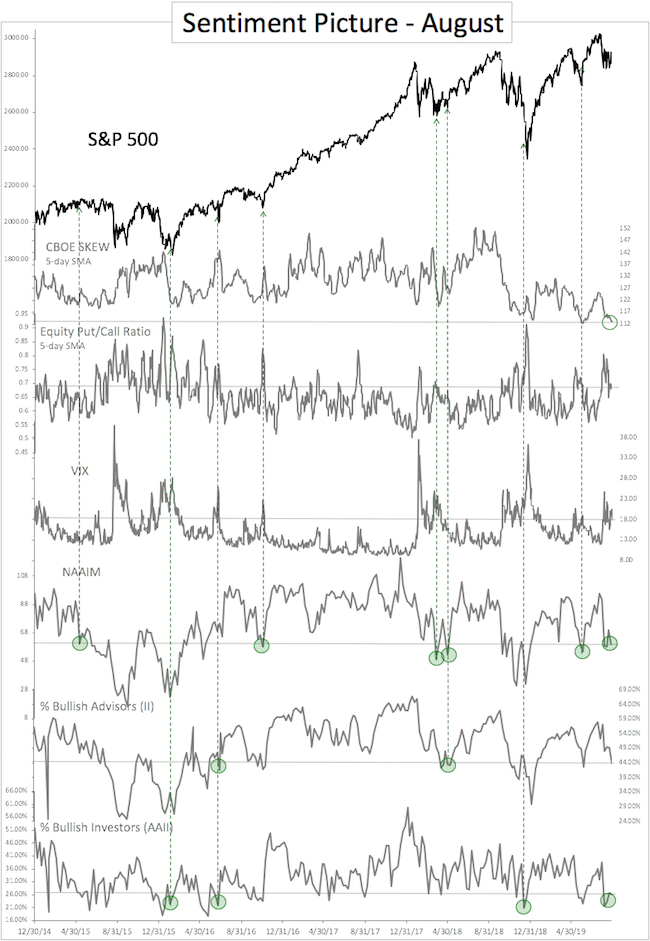

August Sentiment Picture (Published September 2, 2019)

The July Sentiment Picture (published August 3) concluded that: “Short-term sentiment gauges are nearing a point where a bounce becomes likely. We’ve seen many bounces turn into spirited rallies (and this may happen again), but longer-term bullishness allows for additional losses after any bounce.”

The S&P 500 found a low the next day, but bounces (thus far) lacked escape velocity and remained within a trading range.

The following longer-term sentiment polls went from bullish to bearish (bearish considering how close the S&P 500 is to its recent all-time high):

-

National Association of Active Investment Managers (NAAIM)

-

Investors Intelligence (II)

-

American Association for Individual Investors (AAII)

The dash green arrows highlight when any of the above-mentioned polls showed similar readings over the past 56 months. Most of them occurred near a significant low.

Since inception of the AAII poll, sentiment (as measured by the AAII bull/bear ratio) was as bearish when the S&P 500 was within 5% of a 52-week high 9 other time (the only such instance in the 21st century was in April 2005). The worst return was 1 month later (S&P 500 down 44% of the time), the best return was 3, 6, and 12 month later (S&P 500 up every time).

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF e-Newsletter

According to Lipper, investors yanked more than $40 billion from equity funds over the past weeks (that’s 0.3% of total equity assets) and 2% over the past year. This is the biggest exodus out of stocks since 2016 and nearly as pronounced as in 2002. This is not a short-term timing tool, but strongly suggest that a deeper correction would be a buying opportunity.

The sentiment-based conclusion made last month (“longer-term bullishness allows for additional losses after any bounce”) has become less likely.

A change of character would have to occur for stocks to fall further despite a number of bearish (bearish relative to how close the S&P 500 is to its all-time high) sentiment gauges.

Short-term sentiment indicators are neutral.

Continued updates, projections, buy/sell recommendations are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's evaluation of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, 24.52% in 2015, 52.26% in 2016, and 23.39% in 2017.

|