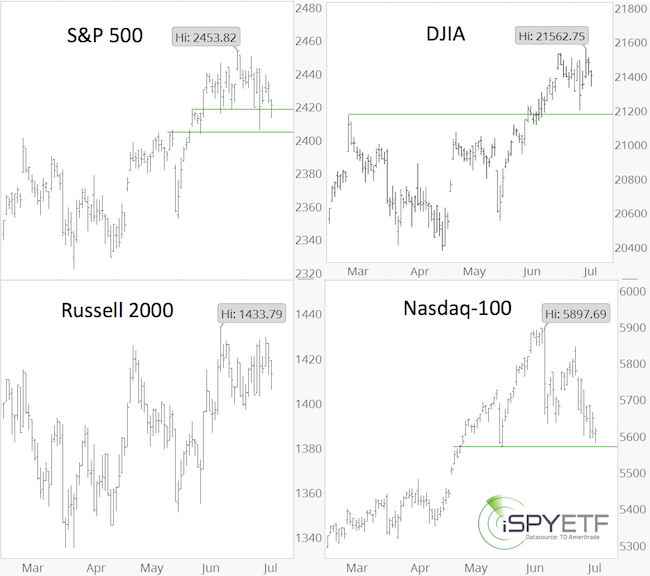

Every major market index has been marching to the beat of their own drum.

The Nasdaq-100 just slid to the lowest level since May 18, while the Dow Jones Industrial Average (DJIA) set a new all-time (intraday) high just on Monday. The S&P 500 is about a percent below its all-time high.

Some reason that there’s no longer enough liquidity to buoy the whole market.

This begs the question, if all this range bound churning is a sign of internal deterioration (and the ‘inevitable’ drop) or if stocks are just taking a breather and revving up for the next spurt higher?

KISS - Bottom Line

The May 29, 2017 Profit Radar Report already observed this: “There are times when indicators line up and we discuss (high) probabilities, and there are times when indicators conflict, and we are forced to discuss possibilities. Unfortunately the later is the case right now.

Each of the major indexes is tracing out a different EWT pattern, breadth measures, seasonality and investor sentiment do not offer a clear message. Therefore we are reduced to dealing with possibilities.

The weight of evidence suggests that in the not so distant future stocks will run into some trouble. The up side target for the S&P 500 is 2,450 – 2,530. The S&P 500, Russell 2000, DJIA and Nasdaq-100 are all overbought, but above short-term support. As long as this support holds, more gains are likely.”

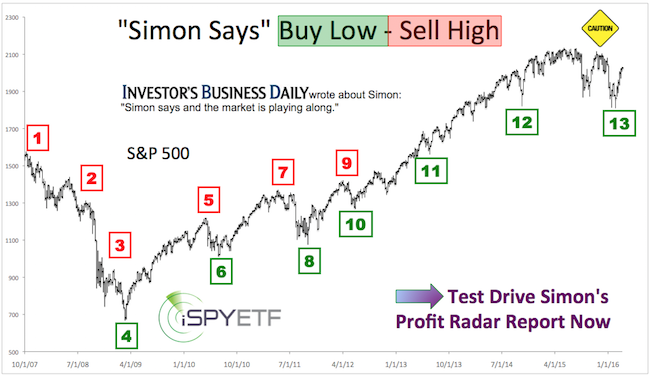

Barron's rates iSPYETF as "trader with a good track record" and Investor's Bussines Daily says "When Simon says, the market listens." Find out why Barron's and IBD endorse Simon Maierhofer's Profit Radar Report.

Not Exciting, but Effective

Ever since we’ve been watching support (which has been at 2,420 for the S&P 500) as stocks have gone nowhere. It should be noted that the 2,420 support level is becoming too obvious and therefore less important. The June 25 Profit Radar Report stated that: "A move below 2,420 (especially 2,400) would increase the odds that a multi-week/month top is in."

Watching support (and resistance) is not the most exciting approach to market forecasting, but there are times where it’s best to realize there are no clear signals (such as in May), and simply wait for the market to offer the next actionable clue.

This approach protects against overtrading or the anxiety associated with a non-performing (or worse, losing) trade. In short, it provides a measure of peace of mind, a rare commodity in this market.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Summary

Mid-and long-term, our comprehensive S&P 500 forecast remains on track.

Short-term, we are waiting if the S&P pushes deeper into the 2,450 – 2,530 target zone, or if the June 19 high at 2,454 was the beginning of a more protracted (but temporary correction).

Whichever direction the market breaks, it will eventually be reversed. Ideally, we are looking to sell the rips (above 2,454 if we get it) and buy the eventual dip (although this dip may last longer than many expect).

Continued updates are available via the Profit Radar Report.

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron's rated iSPYETF as a "trader with a good track record" (click here for Barron's profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|