Poor ‘Mom and Pop’ investors can’t get a break. Some have lumped them in with the ‘dump money’ and others call them the ‘crash indicator.’

Perhaps the issue is not ‘dumb money’ as much as ‘dumb reporting.’

‘Dumb Reporting’ - Not ‘Dumb Money’

Since the beginning of 2013, the media has repeatedly pointed out the bearish implications of ‘Mom and Pop’ getting back into stocks.

Guess what, the S&P 500 has rallied throughout 2013, so either ‘Mom and Pop’ are getting smarter or the media had it wrong.

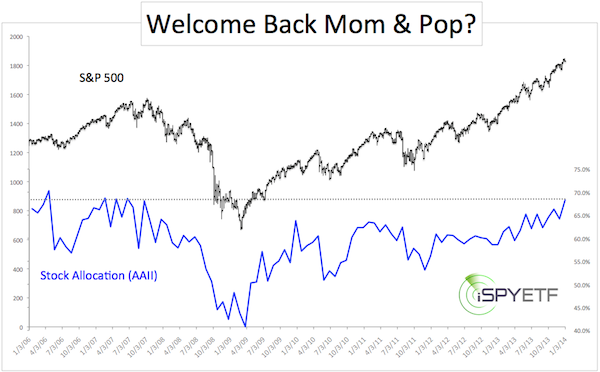

The chart below may have the answer. The chart plots the S&P 500 (SNP: ^GSPC) against retail investors’ allocation to stocks.

Based on the allocation data, provided by the American Association for Individual Investors (AAII) asset allocation survey, ‘Mom and Pop’ didn’t really get fully back into stocks until last month.

In December, retail investors’ allocation to stocks jumped from 64.2% to 68.3%, the highest reading since April 2007. Now we can officially welcome back ‘Mom and Pop.’

Any media spin that ‘Mom and Pop’ already came back early in 2013 along with their bearish conclusions were wrong based on the AAII data.

Still, this question remains: Are ‘Mom and Pop’ getting smarter or are they a contrarian crash indicator?

Are ‘Mom and Pop’ Getting Smarter?

The stock market doesn’t care about ‘Mom and Pop’ or any other investor. It cares about supply and demand (which has been so effectively skewed by the Federal Reserve).

Retail investors have obviously been picking up shares of the S&P 500 ETF (NYSEArca: SPY) and all sorts of stocks. This demand drove up stock ownership and prices.

But the only thing a stockowner can do is hold or sell. Neither action is good for stocks.

The key question is whether there are enough buyers left to bid stocks up further?

To find out, we need to expand our analysis beyond the AAII asset allocation survey and look at a more comprehensive set of sentiment and money flow indicators.

The following article does just that and answers the question:

Did the Strong 2013 Market Cannibalize 2014 Performance?

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|