On August 24, the VIX briefly soared to 53.29, I was getting ready to leave for Europe that day, but saw the action on my phone and thought: “Boy, wish I had the time to figure out a good VIX short.”

I even wrote in the August 24 Profit Radar Report update that: “Today’s VIX high (53.29) will likely stand for a while. Buying XIV (inverse VIX ETN) is tempting, but the issue with XIV is that we may not have the benefit of contango right now, but the drag of backwardation.”

An explanation of contango and backwardation (along with the best seasonal VIX signal) is available here (last two paragraphs).

In short, backwardation is a condition that either increases XIV or SVXY losses or erodes XIV and SVXY gains while the VIX trades above 20 – 25.

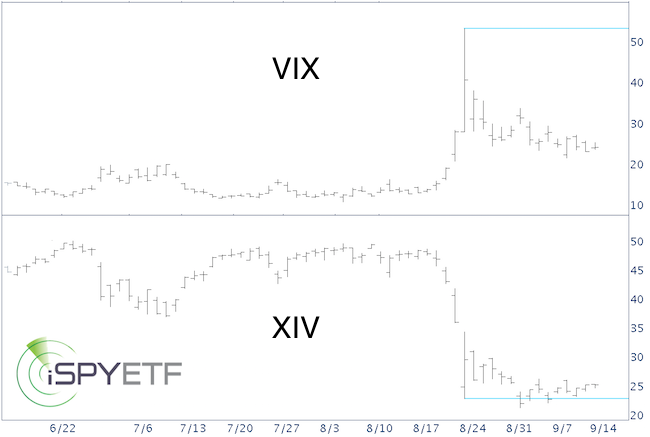

The chart below plots the CBOE VIX against the VelocityShares Daily Inverse VIX ETN (NYSEArca: XIV). Another inverse VIX vehicle is the ProShares Short VIX ETF (NYSEArca: SVXY).

Although the VIX retreated more than 50% since August 24, XIV is up ‘only’ ~10% (SVXY is up ~8%).

Welcome to the power of backwardation.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Understanding contango and backwardation is vital for VIX investors.

Just as backwardation is hurting XIV and SVXY right now, contango will likely benefit them later on this year.

The VIX seasonality chart offers strong clues when the next good setup will be. This is the same VIX seasonality chart that triggered a buy signal in early July.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|