What is the most important number in finance?

GDP, unemployment rate, consumer confidence, or CPI?

The most important number in finance is the 10-year US Treasury Yield (Chicago Options: ^TNX).

When this number changes, almost every other number in finance changes.

The 10-year yield nearly doubled since May. The 7-10 Year Treasury Bond ETF (NYSEArca: IEF) dropped as much as 10%, a huge move for Treasury Bonds. The iShares Barclays 20+ Treasury Bond (NYSEArca: TLT) fell as much as 16%.

With rising yields came higher mortgage rates. But it doesn’t stop there. The yield rally also stifled stocks’ performance in two ways:

1) Low interest rates make bonds less attractive to investors and force them to move into stocks (NYSEArca: VTI). Bernanke calls this much-desired side effect the ‘wealth effect’ (although it robs retirees of their income).

2) Rising interest rates cause higher loan rates for businesses. This puts a squeeze on the profit margin and ultimately the stock price.

Yes, the 10-year yield is arguably the most important number in finance and therefore the chief target of Bernanke’s QE programs. The Federal Reserve buys its own Treasury bonds in an attempt to drive interest rates lower.

In the financial heist game it’s called an inside job.

Ironic QE Revenge

Ironically for much of 2013, the 10-year yield has been revolting against its puppet master (the Fed). The almost unprecedented 2013 yield rally is the opposite of the Fed’s objective.

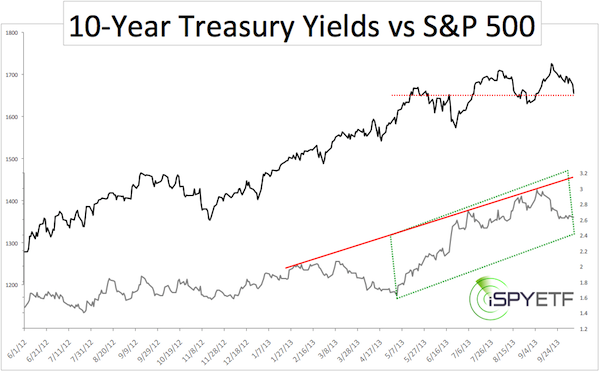

The chart below plots the S&P 500 (SNP: ^GSPC) against the 10-year Treasury Yield.

1) The green box highlights the unwanted, unexpected and unprecedented yield rally.

2) The solid red lines marks yield resistance mentioned by the September 8 Profit Radar Report: “Yields have been rising dramatically, but may be at or near a top (at least a temporary one). As long as yields stay below 3%, odds are starting to favor falling yields and rising Treasury prices.”

Yields tumbled as much as 12% since.

3) The dashed red line shows what the S&P 500 (NYSEArca: SPY) has done since the meteoric yield rally: The S&P 500 is essentially flat and has been range bound since May. Apparently QE money is still finding its way into stocks, but rising yields prevented further gains for stocks.

4) A closer look at the correlation shows that rising yields are not always bad for stocks and shouldn’t be used as a short-term indicator.

Yield Outlook

The long-term trend for the 10-year yields seems to have changed from down to up. Over the short-term, yield may drop a bit further to digest the recent rally.

As the U.S. politicians are ‘impressively’ demonstrating (debt ceiling battle), U.S. Treasuries are not without risk. Even if/once an agreement is hammered out, the long-term futures for Treasuries doesn’t look bright.

As mentioned earlier, the Federal Reserve is deliberately inflating Treasuries. At one point the much-feared taper will begin. Via a brilliant preemptive move - probably in an effort to deflect responsibility - the Federal Reserve has already warned of a market crash (not caused by the taper of course). More details about the Fed's market crash warning can be found here:

Surprising Fed Study - Is it Warning of a Market Crash?

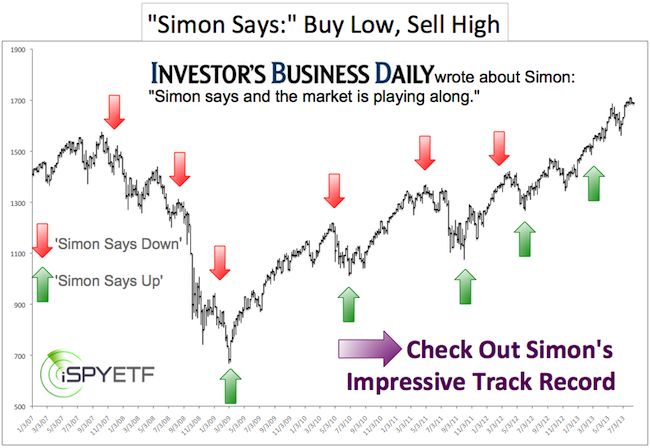

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|