European Central Bank (ECB) president Mario Draghi called off his speaking engagement at the Federal Reserve’s Jackson Hole conference – he had bigger fish to fry.

Earlier in August, Draghi publicly pledged to do “whatever it takes” to prevent the break up of the euro currency. But what exactly is “whatever it takes?”

Many interpret Draghi’s statement as an indication that the ECB will soon be buying large quantities of government bonds issued by essentially bankrupt eurozone countries. Another anonymous source reports that the ECB is planning caps on yields.

Perhaps the only way to cap yields on struggling countries bonds is for the ECB to step in and scoop up large amounts of those bonds to increase demand and thereby lower yields. To a small extent the ECB has been doing just that.

However, there are three factors that may easily derail this plan:

1) The European treaties do not permit the ECB to print money to buy bonds on a larger scale.

2) Germany, burned by hyperinflation in the 1920s, will oppose anything really inflationary.

3) The German constitutional court has to first decide if the European Stability Mechanism – the entity anointed to solve the European debt crisis – is even legal.

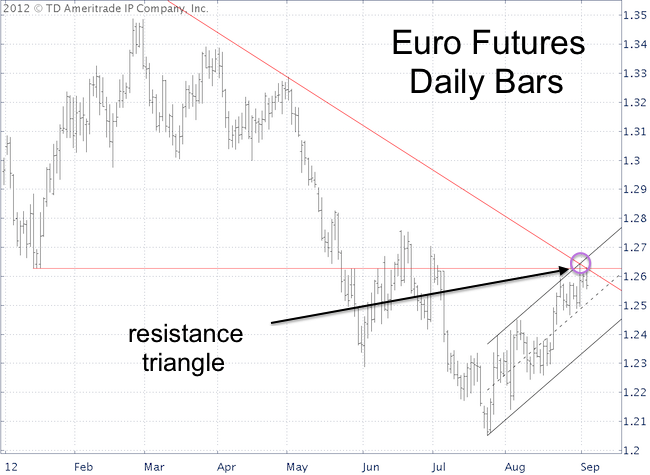

Despite all the uncertainty, the euro and its ETF counter part the CurrencyShares Euro Trust (FXE), has rallied. On August 31, the euro futures rallied right into a resistance triangle that would mark the ideal end of the euro’s advance (see chart below).

Of course nothing is rarely ever ideal and this latest euro top lacked the kind of RSI divergence often present at larger scale tops. Nevertheless, this triangle could turn out to be a “Bermuda triangle for euro prices.”

Euro ETFs or euro linked ETFs that benefit from falling prices of the euro currency include the UltraShort Euro ProShares (EUO), an inverse 2x leveraged euro ETF, and the PowerShares DB US Dollar Bullish ETF (UUP).

The U.S. dollar moves in the opposite direction of the euro, therefore lower euro prices will result in a rising dollar. UUP attempts to replicate the performance of the U.S. dollar.

The ECB will be meeting on September 6 to discuss their bond buying options and the German constitutional court is scheduled to discuss the ESM on September 12.

Those events are likely to create some volatility for the euro currency, but for now the low-risk trade is to go short against the red descending trend line, currently around 1.2630.

Detailed trade recommendations are provided via the Profit Radar Report.

|