Sunday’s Profit Radar Report featured the following charts and analysis for the Dow Jones Averages:

Dow Jones Industrial Average (DJI):

“The Dow Jones Industrial Average (DJI) appears to offer the most clues at this moment. The weekly bar chart shows double support (trend line and prior September high) right around 17,350 – 17,300. The 20-month SMA is at 17,198. This is not must hold support, but it’s a general zone worth watching for a potential bounce.”

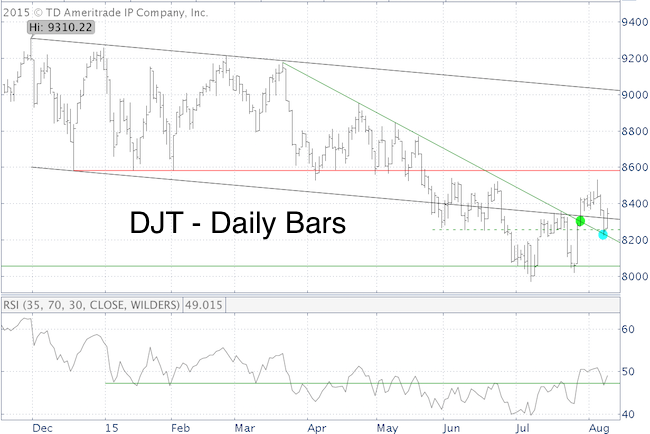

Dow Jones Transportation Average (DJT):

“The Dow Jones Transportation Average (DJT) broke above double trend line resistance (green circle) on July 29, but didn’t produce the ‘escape velocity’ needed to continue moving higher. In fact, the DJT has now returned to its original breakout trend line (blue circle). This kind of back test often serves of launch pad for the next spike. We’ve seen a few failures of a similar launch pad lately, but this is still one of the more reliable technical patterns.”

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Summary:

“We don’t want to ignore some credible indicators pointing towards a correction, but based on sentiment (in particular the equity put/call ratio), it is hard to believe that stocks will drop hard. A bounce is more likely.”

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

|