If you feel like you’ve missed the boat, you are in good company.

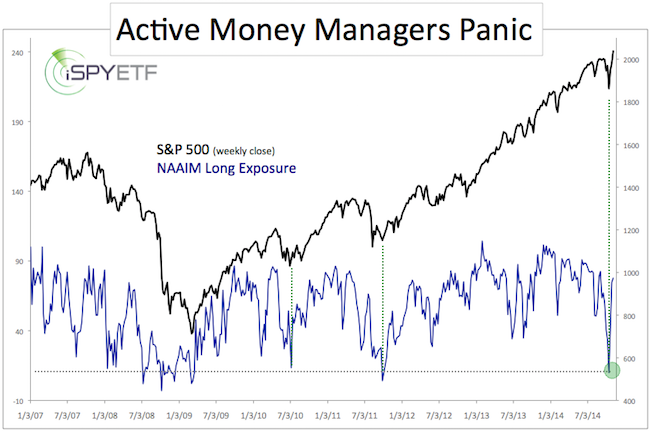

The chart below plots the S&P 500 against the long exposure of active money managers.

The data shows that money managers panicked and hit the sell button the very day the S&P 500 bottomed. Many of the pros have been chasing the rally ever since, one of the reasons it's been so relentless.

Is it too late to get in?

Short-term, stocks are stretched and could correct a couple of percent at any given time. But, they could also just grind higher.

Longer-term, higher prices are still likely, so owning stocks is a good idea.

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

But nobody wants to buy right before a potential pull back.

How can you limit risk?

Look for sectors with the following characteristics:

-

Bearish sentiment score

-

Less overbought relative to its peers

-

Attractive risk management levels and risk/reward ratio

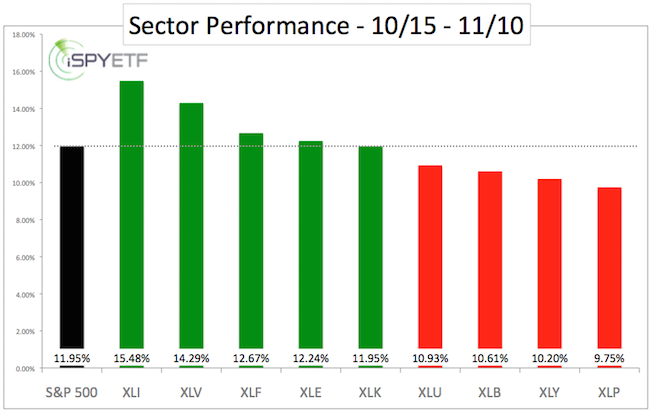

The chart below shows the performance of the nine S&P 500 sectors compared to the S&P 500 (from the October 15/16 low until Monday’s close).

I’m not advocating buying laggards, but there is one lagging sector that sports a historically extreme sentiment score (which should be bullish) and a technical setup that allows for decent risk management.

The one sector that just made it on top of our shopping list is highlighted in Monday’s Profit Radar Report update.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|