The euro has been more or less in freefall mode since May 2014. Downside momentum increased even more this week.

Nevertheless, commercial traders, industry experts with deep pockets, have been buying the euro.

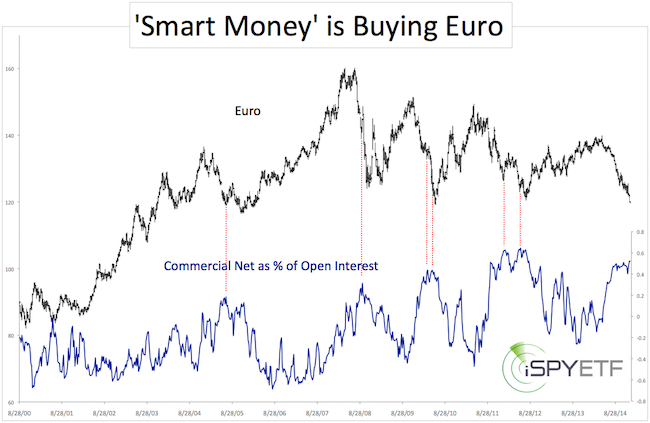

The chart below plots the euro against net long positions (as percentage of open interest) by commercial traders (data source: Commitment of Traders Report).

As the red lines illustrate, commercial traders are often early, but eventually proven correct. Sentiment is favorable to look for a euro bottom.

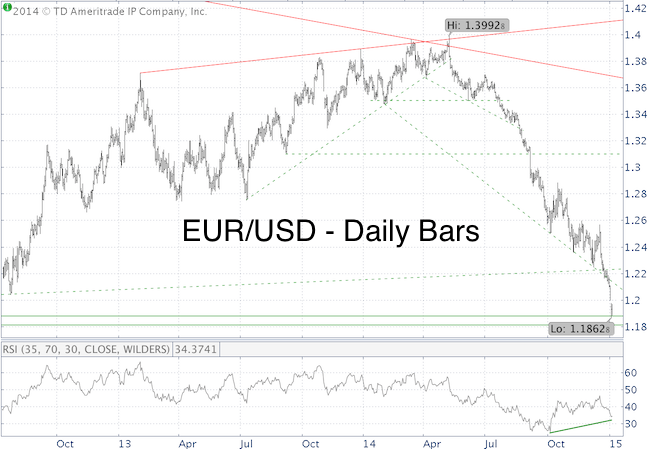

The EUR/USD chart shows the currency slicing through support levels like a knife through butter.

Despite the euro’s renewed freefall since the beginning of 2015, RSI has not confirmed the new lows.

There are a couple of support levels around 1.18, so based on sentiment and technicals it is possible that the euro will carve out a low and stage a significant multi-month retracement rally.

ETFs that benefit from a change of trend are the CurrencyShares Euro ETF (NYSEArca: FXE) or PowerShares DB US Dollar Bearish ETF (NYSEArca: UDN).

Leveraged ETFs are available, but are thinly traded.

A euro rally will obviously affect commodities like oil, gold, and silver.

Continued updates will be provided via the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|