No indicator works all the time, but when indicators are on a winning streak, I like to milk them while they’re hot.

Commercial traders' gold position has been one of those hot indicators.

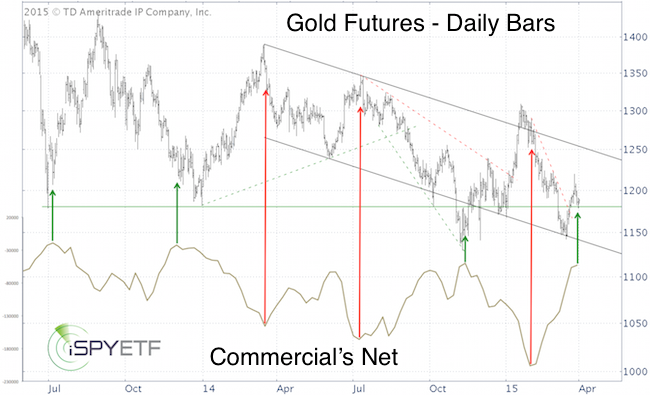

I’ve watched commercial traders for many months, and the sentiment data shown below was part of the reason why I recommended buying gold (via the Profit Radar Report) at 1,140 in November, and selling gold around 1,290 in January.

The chart below plots the price of gold (NYSEArca: GLD) against the net position of commercial traders.

Commercial traders are the ‘smart money.’ They are in the business (i.e. gold miners) and by default ‘long gold.’ Since commercials’ hedge their natural exposure, they are generally net short.

In recent weeks hedgers have been aggressively trimming their short exposure, like they did prior to the November 2014, December 2013, and June 2013 lows.

The commercial trader bullishness is in harmony with the following analysis published in the March 8 Profit Radar Report:

“Gold is now below support at 1,180. We’ll watch sentiment in the coming weeks, but based on the price pattern a double bottom followed by a tradable rally seems likely. The low could occur slightly above or below the November low (1,129.80).”

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

It looks like gold futures bottomed at 1,145 on March 18, which was just $15 away from last November’s low at 1,130.

Based on sentiment, pullbacks like the current one are buying opportunities.

Gold has also been tracking its historic seasonal patterns rather closely. A detailed look at gold seasonality and continued gold analysis is available via the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|