When buyers become scarce prices fall. This facet of the supply/demand principle applies to every market, including the stock market.

How can you monitor the supply of buyers? There is no foolproof way, but investor sentiment and money flow data are a good gauge.

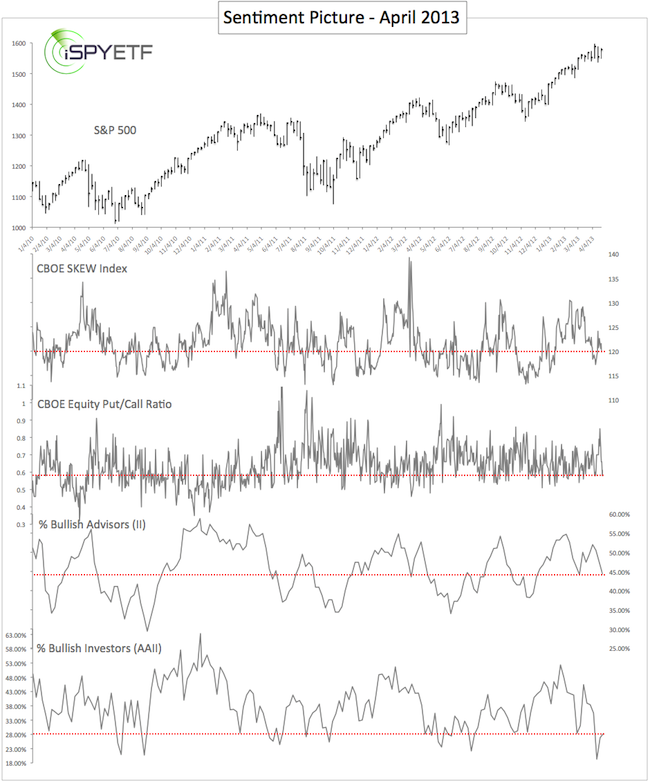

The Profit Radar Report consistently monitors dozens of different sentiment and money flow stats and publishes a broad summary every month (called the Sentiment Picture).

This year’s sentiment readings have been the most schizophrenic I’ve ever seen.

It started in February when sentiment polls conducted by Investor’s Intelligence (II) and the American Association for Individual Investors (AAII) registered extreme readings. Those extremes, however, were not confirmed by actual money flow indicators (such as the option put/call ratio, margin debt and money invested in bullish vs bearish funds).

The February 15, Sentiment Picture drew that conclusion: “Investors may not be putting their money where their mouth is.” Money flow discredited bullish sentiment readings and suggested further up side.

The media is another contrarian indicator that falls into the sentiment category. There is no media index, but if you study the headlines every day you develop a feel for media sentiment.

The March 10, Profit Radar Report noticed that: “The media seem to embrace this rally only begrudgingly and is quick to point out the ‘elephant in the room’ – stocks are only up because of the Fed. Below are a few of last week’s headlines:

CNBC: Dow Breaks Record, But Party Unlikely To Last

Washington Post: Dow Hits Record High As Markets Are Undaunted By Tepid Economic Growth, Political Gridlock

The Atlantic: This Is America, Now: The Dow Hits A Record High With Household Income At A Decade Low

CNNMoney: Dow Record? Who Cares? Economy Still Stinks

Reuters: Dow Surges To New Closing High On Economy, Fed’s Help

We know this is a phony rally, but so does everyone else. We know this will probably end badly eventually, but so does everyone else. The market likes to fool as many as possible and it seems that overall further gains would befuddle the greater number. Excessive optimism was worked off by the February correction. Sentiment allows for further gains.”

The April 26, Sentiment Picture (chart below) noted that: “36% of advisors and newsletter writers polled by Investor's Intelligence (II) are looking for a correction. Incidentally, that's exactly what we are expecting. However, the market rarely fulfills the expectation of the masses. A bullish surprise is possible.”

Market is Getting Hot, But Correction Talk is Getting Old

The percentage of advisors waiting for a correction has since dropped to 26% and a widely featured Reuters article exclaimed that “Correction talk gets old as rally sails along.”

As the media, investors, and newsletter writers are starting to discount the odds for an upcoming correction, we should become more alert and less complacent.

More importantly, there’s been a notable shift in money flow indicators. Investors are now actually putting their money where their mouth is. This is significant. Why?

There is a tipping point where there are simply not enough buyers left to push prices higher. Where is that tipping point?

The brand new Sentiment Picture for May (published by the Profit Radar Report) shows exactly how close various sentiment and money flow indicators are to their tipping point.

|