Tightrope walkers know the value of a safety net. You may never actually need the safety net, but it will save your life if you do.

Key support levels for stocks (VTI) are like safety nets for investors, as a drop below support is often 'deadly' for a portfolio.

Does your portfolio have a safety net? Key support levels for stocks are much tougher to spot than an actual safety net.

Unbeknownst to many, the S&P 500 (^GSPC) bounced from support already on Thursday.

The hourly S&P 500 chart below shows the trend lines and support/resistance levels making up the S&P 500 (SPY) safety net. Here are the most important facts:

1) Thursday’s decline filled an open chart gap at 1,672 (purple line). The September 29 Profit Radar Report pointed out this open gap and stated that: “There’s an open chart gap at 1,672.40. Chart gaps have acted as magnets and the S&P should dip to close this gap."

2) There is triple support just below the open chart gap.

3) On Friday the S&P 500 (VOO) closed above the black trend channel and above the green trend line. This was actually bullish, but an intraday Friday Profit Radar Report update shared this concern: "We are watching this mornings rally with a degree of suspicion. There's some risk of a gap down open on Monday."

This suspicion is still alive. However, we allow the rally to develop further as long as trade remains above support (1,660 - 1,670).

The rising green trend line (today at 1,668) seems like the ideal 'make it or break it' point, and a break below may well lead to a sizeable decline. However, since 2011 the S&P 500 has seesawed over similar trend lines a couple of times. The October 7 Profit Radar Report discussed the best possible entry point to go short (or long).

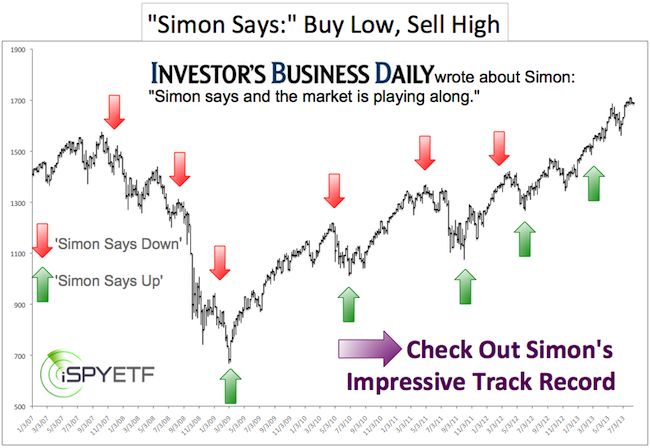

Simon Maierhofer is the publisher of the Profit Radar Report.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE Newsletter.

|