Now that’s odd. Retail investors turned record bearish just as the S&P 500 clocked in at an all-time high.

The percentage of bearish investors polled by the American Association for Individual Investors (AAII) just dropped to 19.31%, the lowest reading since at least 2007.

The value of investor sentiment polls lies in their contrarian implications; as such stock market highs are usually accompanied by record bullishness, not record bearishness.

There is no precedent to this sentiment anomaly, and according to AAII there was no error in this week’s data. Although the participation rate was lower than usual (145 responses instead of a 3-month average of 330), previous drops in the number or respondents have not resulted in the same magnitude of change.

What does this mean for stocks?

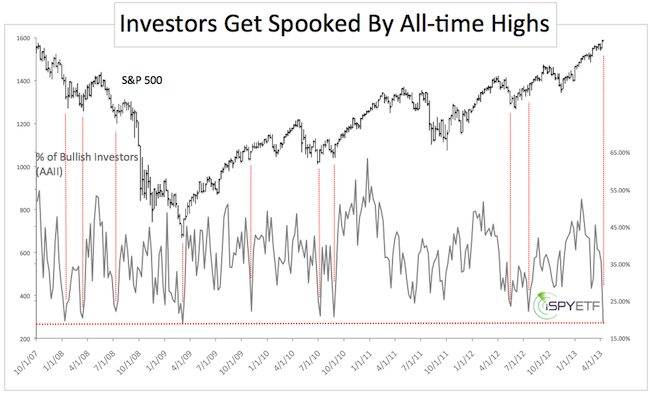

The chart below plots the S&P 500 against the percentage of bullish retail investors polled by AAII. As the red lines indicate, every reading of 20 or less coincided with some sort of low.

I tend to discount the AAII figures, as this study is the most irrational of all the sentiment gauges I follow. But that doesn’t mean it should be ignored.

A number of recent articles highlighted various red flags for stocks. The unusual AAII result emphasized the need to wait for sell signals to be triggered before going short and to allow more up side as long as stocks trade above support.

Key support levels and sell signal triggers are published via the Profit Radar Report.

|