15 years after the tech bubble, the Nasdaq Composite finally closed at a new all-time high. On the same day, the S&P 500 (NYSEArca: SPY) briefly spiked to a new intraday high.

This is not surprising, since we just discussed that 'Under the Hood is More Strength than the S&P 500 Chart Shows' (for how long remains to be seen).

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

Let’s pretend for a moment the S&P also closed at an all-time high, and look at historic precedents when both indexes clocked in at new all-time highs on the same day.

Since the infamous ‘sell in May, and go away’ period is almost upon us, let’s further narrow down our search to matching all-time highs scored in the month of April.

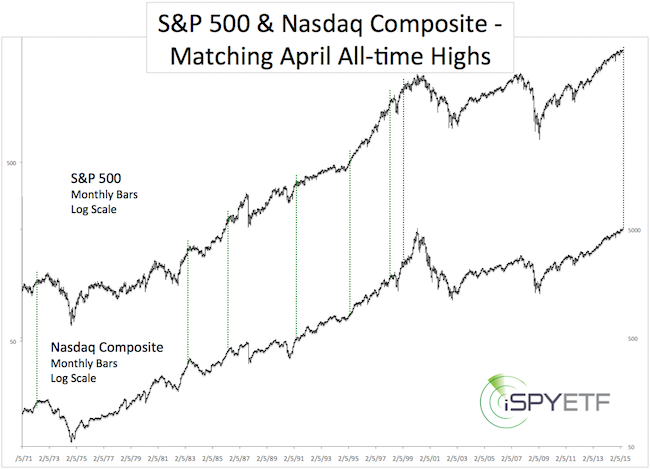

The chart below does just that. The dashed green lines mark matching April highs.

Things always get a bit tight when cramming 41 years of data into one chart; nevertheless, both indexes visibly struggled the months following matching April highs. The only exception was April 1995.

Short-term, the S&P 500 broke above resistance (discussed here). Based on technical analysis, this is bullish. But other indicators suggest that up side could be limited. Why? More details here.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

Never Miss a Beat! >> Sign up for the FREE iSPYETF e-Newsletter

|