Before we talk about the blogosphere paparazzi, allow me to set one thing straight: I don'd like the Federal Reserve and I'm not sticking up for the Federal Reserve.

The Federal Reserve is an institution set up by bankers for bankers, an insurance company for the bankster mafia.

However, an analyst, reporter, journalist, or blogger should be driven by facts, not personal biases or dislikes. Just because an institution has a closet 'packed with skeletons' doesn't give us the right to invent misleading information.

It's no secret that the Federal Reserve has been pumping money in the market, sending indexes like the S&P 500 (SNP: ^GSPC) and Dow Jones (DJI: ^DJI) to never before seen highs; in the process enriching the very banksters that caused the worst financial collapse since the Great Depression.

The Federal Reserve is the deserving scapegoat for many wrongs committed on Wall Street.

But publishing sensationalized and misleading reports just for the sake of capturing attention is bad for investors. How so?

Just recently, a very popular blog stated that "QEternity may have to be increased by 50% in the coming year."

This claim was based on a tweet by the president of the Chicago Federal Reserve, Charles Evans (see original tweet below):

According to Evans' tweet, the Fed may need to purchase $1.5 trillion in assets until January.

How Does $1.5 T Compare to Current Asset Purchase Pace?

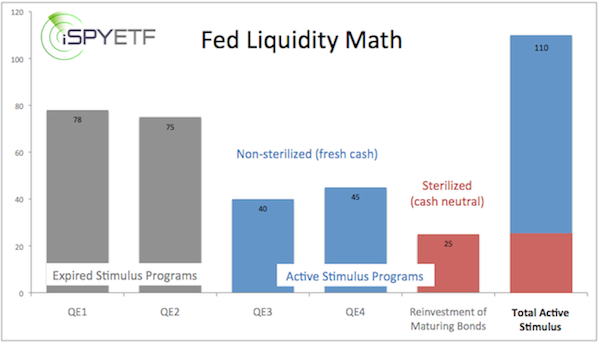

Based on the assumption that the Fed is buying $85 billion worth of bonds per month ($1.02 trillion/year), we can see where the 50% increase claim is coming from.

However, the haphazard calculation overlooks the fact that the Federal Reserve is ALREADY spending an additional $25 billion per month on reinvestment of maturing bonds. Is that what Charles Evans may have meant?

Mortal humans just don't have the ability to decode the enigma-like messages of Federal Reserve personnel, but based on the numbers in Evans's statement it could mean that asset purchases will continue at the same pace or that asset purchases may only increase 26% - $85 b x 14 (November 2013 - January 2014) compared to $1.5 trillion.

This conclusion is less sensationalistic, but it won't persuade investors to buy into the S&P 500 or Dow Jones just because the Fed may beef up asset purchases.

It's not necessary to 'enhance' Federal Reserve news to make them more interesting. The Federal Reserve is quite capable of making fools of themselves without anyone else's help.

For example, an official 2012 Federal Reserve study (posted on the Federal Reserve NY website) revealed that the Fed's FOMC meetings drove the S&P 500 55% above fair value and that the S&P 500 (NYSEArca: SPY) would be flat since 1994 if it wasn't for the Fed (click here for report: Federal Reserve Study: FOMC Drove S&P 500 55% Above fair value).

In direct conflict with the above study, a recent official report by the Federal Reserve of San Francisco claims that the Fed's QE barely affected stocks and the economy (click here for report: Federal Reserve Reflects Responsibilty for Stock Market Overvaluation)

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. We are accountable for our work, because we track every recommendation (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|