A document discovered by Reuters (available here) revealed two shocking developments in Europe.

1) Reuters reports that: “The EU is looking for ways to wean the 28-country bloc from its heavy reliance on bank financing and find other means of funding small companies, infrastructure projects and other investments.”

Obviously, the EU economy is growing too slow and the few visible green shoots aren’t of the organic sort. To boost growth, EU executives are proposing this scary and revolutionary solution:

“The savings of the European Union's 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis, an EU document says.”

According to the document, the EU Commission will ask the bloc’s insurance watchdog later on in 2014 for ways to “mobilize more personal pension savings for long-term financing.”

Keep in mind that politicians are crafty when it comes to using appealing and concealing verbiage, so let’s try to translate a couple of specific terms.

What does “Savings of EU citizens could be used to fund …” and “mobilize more personal savings” really mean?

Obviously, EU citizens don’t feel comfortable willingly investing in the kind of shenanigans the EU Commission (and probably EZB) is about to propose.

“Mobilize more personal pension savings” is more attractive than confiscate, but essentially means the same thing.

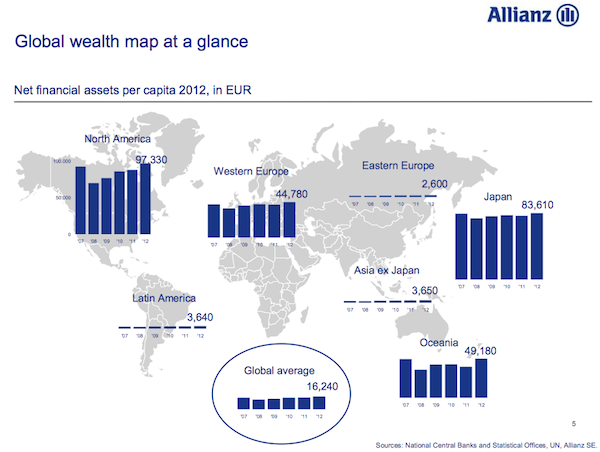

How much money are we talking about? A quick thumbnail calculation based on the data of Germany’s insurance giant Allianz (which pegs the per capita wealth of Western Europe at 44,780 euro) suggests total private assets amount to roughly 17 trillion euros (or $23.3 trillion).

2) Additionally, the EU Commission apparently would like to do away with fair value pricing in connection with long-term securitization of mortgages and trading of corporate bonds.

Let’s review and allow a moment for this to sink in: The EU economy is weak. The money of its citizen is to be used (seemingly against their will) to create the kind of financial products that caused the post-2007 financial crisis. Accounting standards are to be changed to inflate prices and hide potential losses.

The asset confiscation part is unusual even by U.S. standards, but the proposed accounting trick was born in the U.S. before it appeared in this European proposal.

A similar accounting change, forced by Congress upon the Financial Accounting Standards Board (FASB) via the Emergency Economy Stabilization Act of 2008, miraculously made financial sector (NYSEArca: XLF) losses disappear into a black balance sheet hole called ‘comprehensive income.’

Near bankrupt banks all of a sudden turned profitable (on paper) and the S&P 500 and Dow Jones soared. In fact, this simple accounting trick may have contributed more to the post-2009 S&P 500 (NYSEArca: SPY) and Dow Jones (NYSEArca: DIA) rally than QE.

A concise but striking nutshell explanation of this accounting trick (born in the U.S. before exported to Europe) is available here:

The Simple Trick that Skewed P/E Ratios For Everyone

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|