|

|

| Don’t Fall for This Year-end VIX Trick |

| By, Simon Maierhofer

|

| Tuesday December 23, 2014 |

|

|

|

|

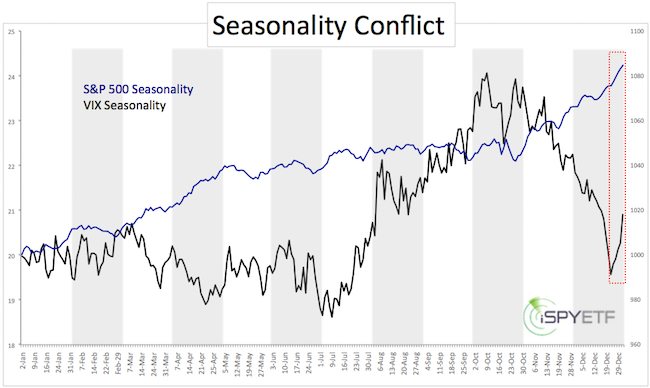

| Some call it Santa Claus rally, others year-end rally. Regardless of the label, S&P 500 seasonality is firmly bullish for the next couple of weeks. But this is not an automatic VIX sell signal, in fact, it tends to be a VIX trap. |

|

It’s the time of year when stocks are expected to rally.

S&P 500 (NYSEArca: SPY) seasonality, based on data going back to 1950, confirms the tendency to end the year on a high note.

At first glance, this looks like a good setup to short the VIX.

Three options to short the VIX are:

-

Buy VelocityShares Daily Inverse VIX ETN (NYSEArca: XIV)

-

Buy ProShares Short VIX ETF (NYSEArca: SVXY)

-

Short iPath S&P 500 VIX ETN (NYSEArca: VXX)

However, S&P 500 strength does not automatically translate into VIX weakness, especially during the final days of the year.

In fact, the VIX tends to rally in late December. The chart below shows that shorting the VIX during the ‘Santa Claus Rally’ period is not the most brilliant of ideas.

If you enjoy quality, hand-crafted research, >> Sign up for the FREE iSPYETF Newsletter

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|

|

|

|

|

|

|

|

|

|

|

|

|

|