The biggest Santa Claus Rally (SCR) cliche doubles as the tallest holiday tale on Wall Street.

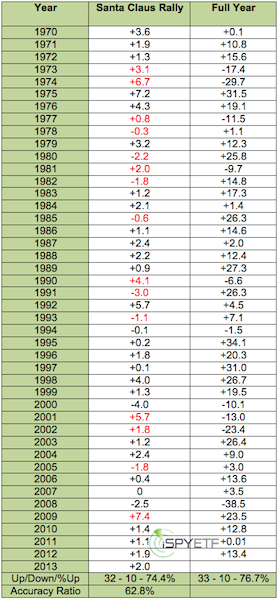

Since 1970 the SCR occurred 32 out of 43 years (74.4%). The SCR includes the last five days of December and first two days of January.

What happens when there is no SCR?

As the saying goes, “if the SCR should fail to call, bears may come to Broad and Wall.”

Is that really true?

Absolutely not!

The table below shows all SCRs and subsequent full-year returns for the S&P 500.

Since 1970 the SCR has failed to call eleven times. Only three of those times (1994, 2000 and 2008) were followed by losses for the S&P 500 and S&P 500 ETF (NYSEArca: SPY).

As an overall barometer for the year ahead, the SCR sports a better track record: 62.8% of the time the S&P 500 (SNP: ^GSPC) followed the directional tone set by the SCR.

As the chart above shows, the SCR was positive the last three years (the January 2, 2013 spike saved the 2012/13 SCR), as was the S&P 500.

The coming weeks will be interesting as various barometers will provide clues about what’s cooking for 2014.

One of those barometers sports a 76.7% accuracy ratio and another, believe it or not, sports a 100% accuracy ratio. The "100% barometer" triggered 16 times since 1950 (including 2013) and was followed by full-year gains every single time. Will it trigger again in 2014?

More details about the 76.7% and 100% accurate full-year indicators is available here:

The 100% Accurate Year Ahead Market Barometer

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (stocks, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. We are accountable for our work, because we track every recommendation (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|